Talking Points:

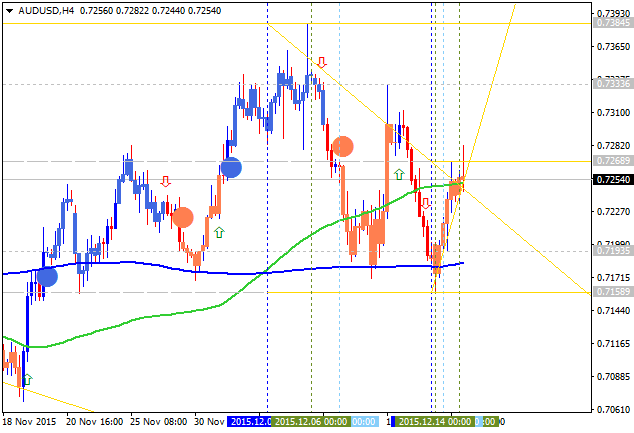

- AUD/USD Technical Strategy: Short at 0.7090

- Australian Dollar Rebound Loses Steam Immediately After Resistance Break

- Short Trade Aiming Sub-0.70 Triggered on Signs of Down Trend Resumption

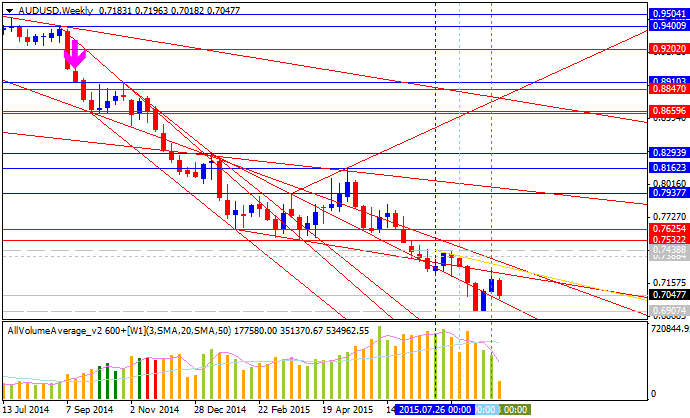

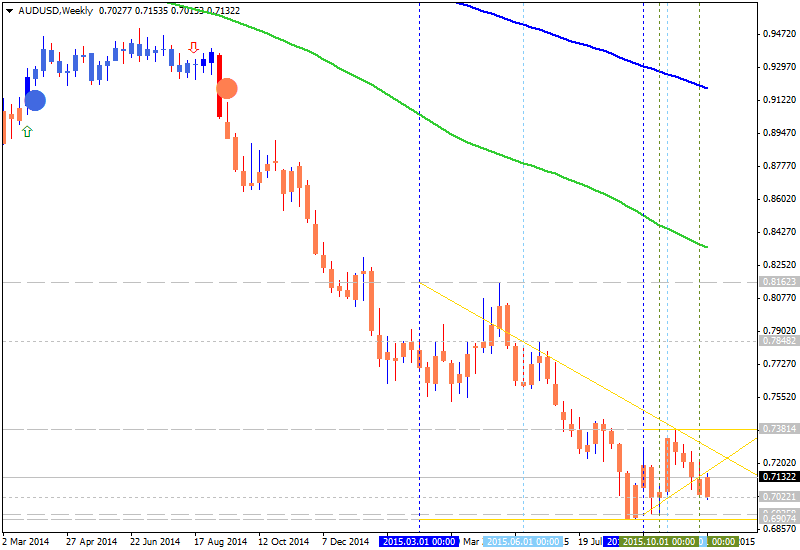

The Australian Dollar may be readying to resume its long-term down trend against its US namesake having found resistance below the 0.73 figure. Prices recovered as expectedafter putting in a bullish Morning Star candlestick pattern and even breached trend line resistance capping gains since mid-May, but the move swiftly stalled thereafter.

Near-term support is now at 0.6983, the 23.6% Fibonacci expansion, with a break below that on a daily closing basis clears the way for a test of the 38.2% level at 0.6800. Alternatively, a recovery back above the 14.6% Fib at 0.7096 – now recast as resistance – opens the door for a challenge of the September 19 high at 0.7279.

We will now enter short AUDUSD, initially targeting 0.6983. A stop-loss will be activated on a daily close above 0.7200. Once the first objective is reached, we will take profit on half of the position and trail the stop-loss to the breakeven level.

more...

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks