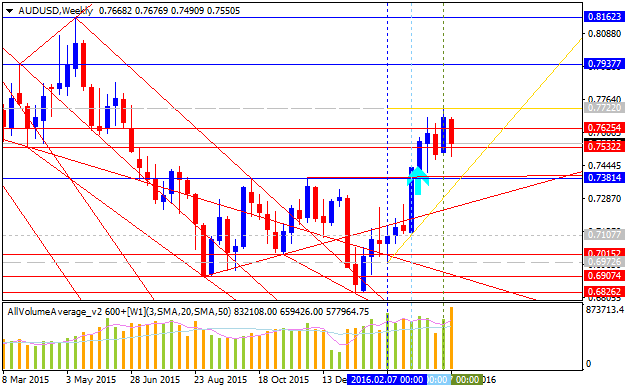

AUD/USD

Weekly

-FXTW was looking for resistance in AUD/USD from the October 2013-January 2014 line near .7800. That level has not been reached and a tweezer top (candlestick pattern…tweezer bottoms identified the lows in September 2015 and January) warns that it may not be reached. Also, risk of a top is heightened given COT considerations. Don’t forget about the cyclical influence next week…

-“The 2nd week of April is lining up as a potentially important pivot in time. The 1993 and 2001 lows (latter is the all-time low) are exactly 392 weeks apart. 392 weeks from the 2001 low is the week of the October 2008 crash (the low was 3 weeks later). 392 weeks from the October 2008 crash is the week of April 11th. My colleague Kristian Kerr, whose cycle work is a must read, often stresses the importance of what a market is doing into a time window. In other words, a high/low could form if the market is heading into resistance/support within the window (and if other conditions are met of course). Also, a break of a key level during this time would warn of possible acceleration in the same direction. Context is key (always is). For now, just know that the week of April 11th is a big point on the X-Axis for Aussie.”

more...

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks