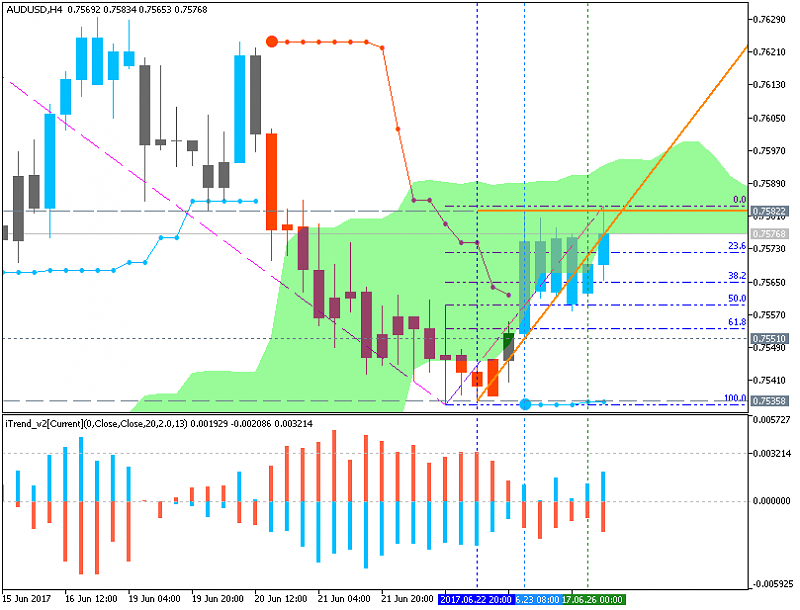

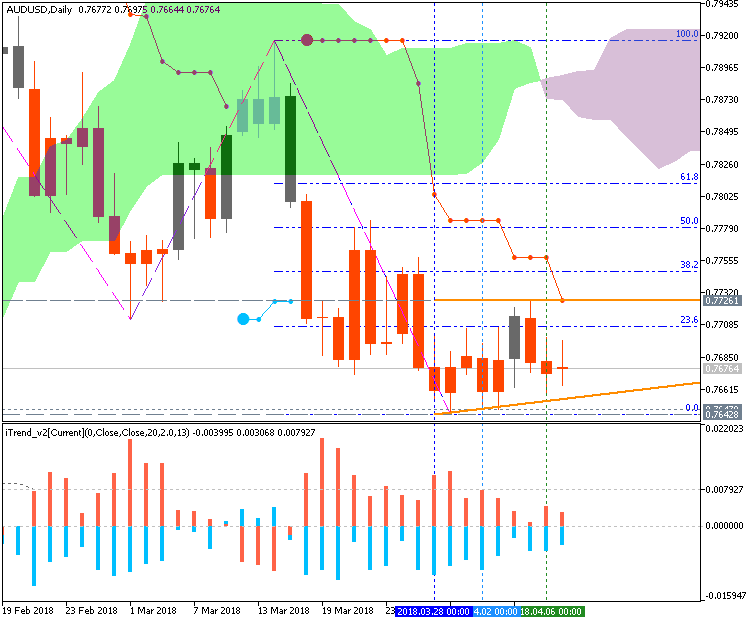

For those intraday traders, we can pinpoint the pattern a little further. A shorter term key level to watch for is the June 13 low of .7524. Holding above this low keeps new highs towards .7640 vulnerable. A break below this level puts bulls on ice while support may form above .7329.

more...

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks