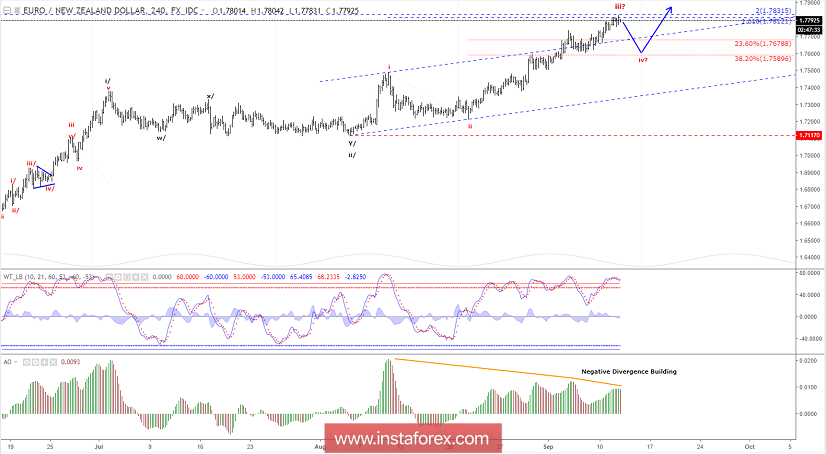

Elliott wave analysis of EUR/NZD for September 11, 2018

EUR/NZD keeps making headway towards the sub-target at 1.7820. Ideally, this resistance will only make a temporary top for the next swing higher towards the more important resistance at 1.8369.

Support is now seen at 1.7668 and if a break below here is seen, then a corrective decline closer to support at 1.7605 could be seen, but it should be short-lived as the steady uptrend continues higher towards 1.8369. R3: 1.8016

R2: 1.7919

R1: 1.7820

Pivot: 1.7738

S1: 1.7701

S2: 1.7668

S3: 1.7605

Trading recommendation:

We are long EUR from 1.7330 and we will move our stop higher to 1.7660.

Analysis are provided byInstaForex.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks