Trump gave up the slack

It seems that Donald Trump will not be able to achieve the desired in negotiations with the Chinese on trade. As usual, last weekend, he reported on his Twitter account that the negotiations were "productive" and he decided to extend the truce after March 1.

In contrast to the American president, the Chinese side does not so vividly reflect the course of the negotiation process, I can even say it generally shows an enviable restraint of the "heavenly". The absence of any complete information from this side clearly indicates that there is no "productivity" in the negotiation process. Most likely, Trump has to back down and announce the continuation of the truce for this very reason, and he has more than enough reason for this.

Last year, the active actions of the American president led to a "failure" in trade between the United States and China, and not only with the latter. The desire to solve all the problems by stifling pressure on competitors in world trade led to a slowdown in the growth of the economy of the PRC, a large Europe and the USA, which led to a general slowdown in the growth of the global economy.

Trump, has not managed to solve the trade problem with China as a whole, and the desire to go to the second presidential term will force him to be more accommodating. Therefore, he will have to soften his position on this sensitive issue.

Taking this into account, one can expect that optimism with a new force will overwhelm the world markets, which will lead to the continuation of local growth in stock markets, while the US dollar will remain under noticeable pressure. The overall demand for risky assets, as well as the expectation that the Fed will not raise interest rates in the current year and even go to stop reducing the balance, will adversely affect the rate of the US currency. In many ways, the positive theme has already been played on the foreign exchange market. That is why in this situation, we also do not expect a noticeable strong growth in the currencies of competitors, since a truce does not solve all problems, but only pushes them away in time and it's hard to say what all this will result in.

Forecast of the day:

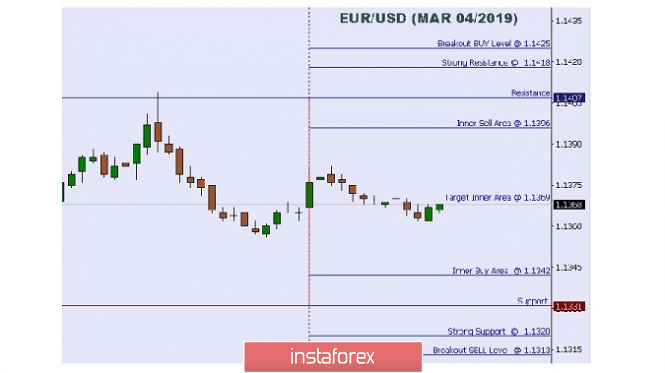

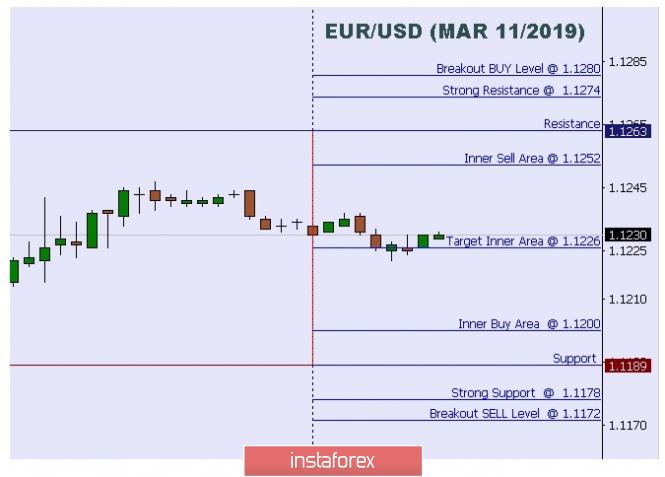

The EURUSD pair is in a very narrow range of 1.1220-1.1370 in anticipation of resolving the situation around Brexit. It is likely that it will continue until tomorrow's speeches by Theresa May and Jerome Powell. It seems that there is not enough local weakening of the dollar exchange rate for the further growth of the pair. Stronger drivers are needed, which May and Powell can provide.

The GBPUSD pair is trading in the range of 1.1260-1.1300, also in anticipation of Theresa May and Jerome Powell speeches.We believe that this range may continue until Tuesday.

Analysis are provided byInstaForex.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks