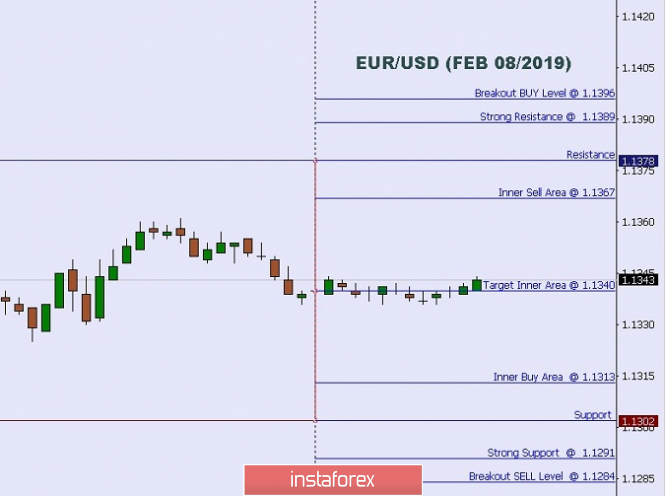

Intraday Level For EUR/USD, Feb 08, 2019

When the European market opens, some economic data will be released such as Italian Industrial Production m/m, French Prelim Private Payrolls q/q, French Prelim Private Payrolls q/q, and French Industrial Production m/m. The US will not publish any economic data today, so amid such conditions, the EUR/USD pair will move with a low to a medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1396.

Strong Resistance: 1.1389.

Original Resistance: 1.1378.

Inner Sell Area: 1.1367.

Target Inner Area: 1.1340.

Inner Buy Area: 1.1313.

Original Support: 1.1302.

Strong Support: 1.1291.

Breakout SELL Level: 1.1284.

(Disclaimer) *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks