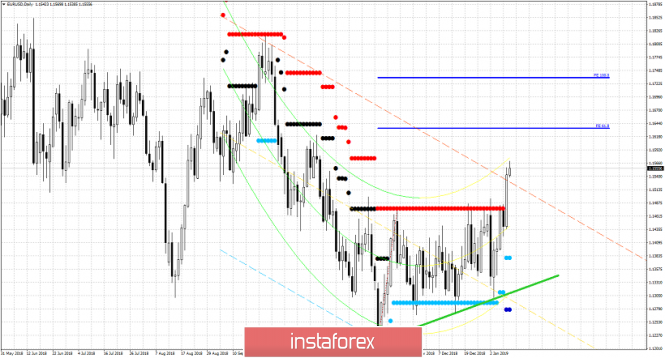

Technical analysis for EUR/USD for January 10, 2019

EUR/USD has finally broken above and out of the trading range it has been in for the last two months. This is a bullish sign. We could see a pullback as a back test towards 1.1450-1.1480 but I remain bullish on EUR/USD looking for at least a move towards 1.17.

Light blue dots - medium strength support

Blue dots - maximum strength support

Green line - trend line support

Blue lines - extension targets

EUR/USD after three attempts at 1.15, buyers have finally broken above it and closed above it as well. We were favoring the bullish scenario despite being in a neutral sideways trend, because of the warning we had seen by the Daily RSI bullish divergence. Our target is now at 1.17 and any move higher will increase the chances of a major low to be in place at 1.1215 and a new up trend to start. A daily close below 1.1435 is something bulls do not want to see.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks