Forecast for USD / JPY on November 29, 2018

Yesterday, the Japanese yen was able to withstand the onslaught of counterdollar currencies at the speech of Fed Chairman Jerome Powell, but this resistance weakened today in the Asian session - the yen's decline is 32 points. Of course, the yen has a traditional patron - the stock market. Yesterday, the S & P500 added 2.3%. Today, the Nikkei225 is growing by 0.61%. It seems that the stock market rally has already begun. According to the data released today, retail sales in Japan added 3.5% y / y in October against the forecast of 2.7% y / y. Tomorrow, a whole block of positive changes are expected: industrial production growth in October is 1.3%, the base CPI of the capital Tokyo in November from 1.0% y / y to 1.1% y / y. Consumer confidence index is expected to be 43.3 against 43.0 earlier, the number of new housing bookmarks is from -1.5% y / y to 0.4% g / g.

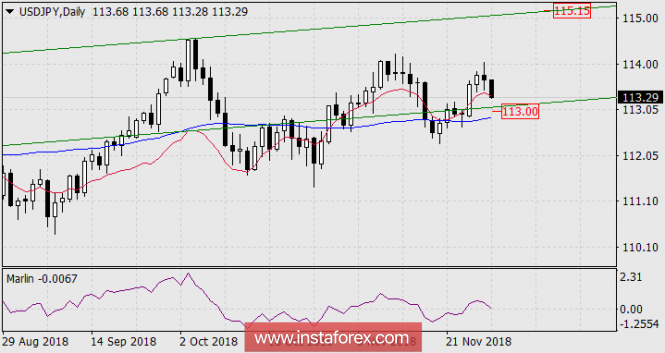

At the moment, the price is close to the Krusenstern indicator lines and the balance on H4, but as part of the fluctuation, it is possible to reduce to support for the daily scale in the area of 113.00. From the level, we are waiting for the price reversal up to the resistance of the trend line of the price channel (115.15).

Analysis are provided byInstaForex.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks