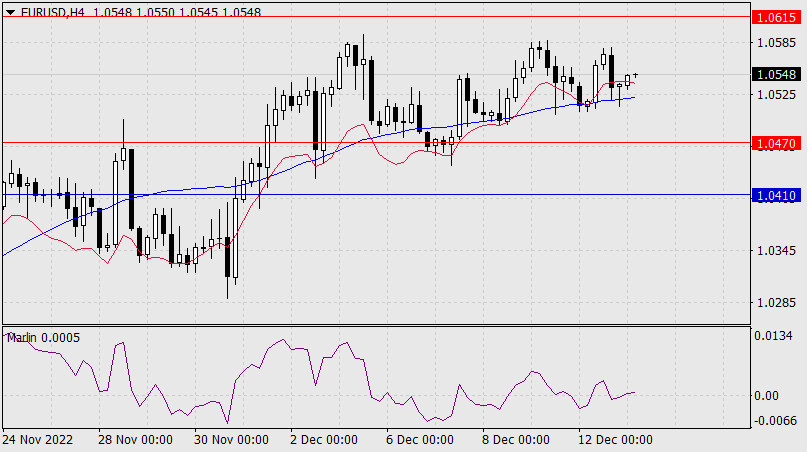

Forex Analysis & Reviews: Forecast for EUR/USD on December 2, 2022

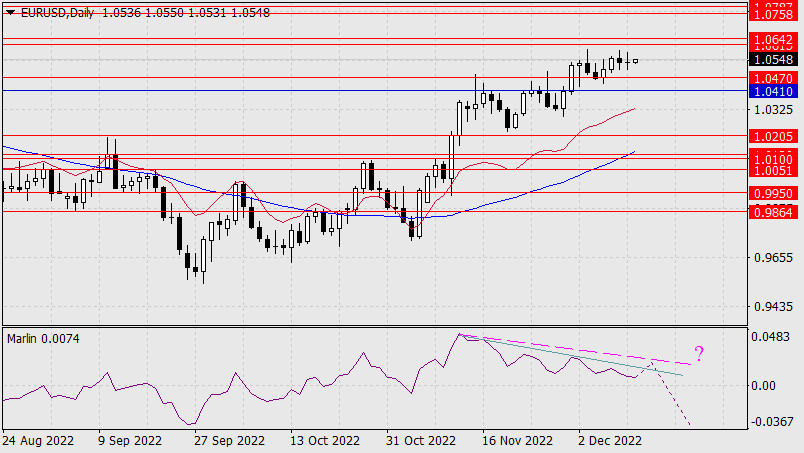

In anticipation of today's US jobs data, on the back of Federal Reserve Chairman Jerome Powell's seemingly not obvious dovish speech, the euro rose 119 pips yesterday. The price crossed the target level of 1.0470, the peak of November 28, and is now heading to the target range of 1.0015/42. The range is defined by the highs of June and May. So far, the price is going with our scenario with forming a divergence when the target range is reached.

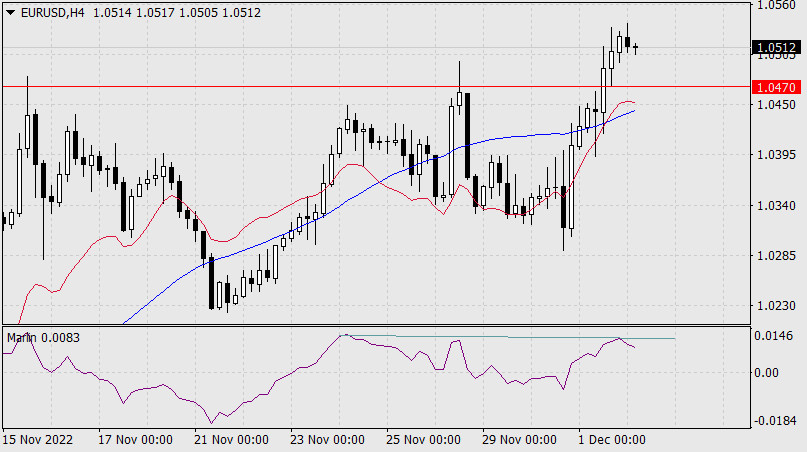

On the four-hour chart, there is a sign that a double divergence is forming with the Marlin oscillator. In the current market sentiment, it may mean a pause in growth in anticipation of new important information. That will be the U.S. employment data for November. Forecast is 200,000 new jobs, compared to 261,000 in October.

The improving dynamics of weekly unemployment claims and yesterday's drop of the ISM Manufacturing Employment subindex from 50.0 to 48.4 might be weaker than expected. Traders will be waiting for this situation to become clearer.

Analysis are provided by InstaForex.

Read More

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks