Forex Analysis & Reviews: Forecast for EUR/USD on July 15, 2022

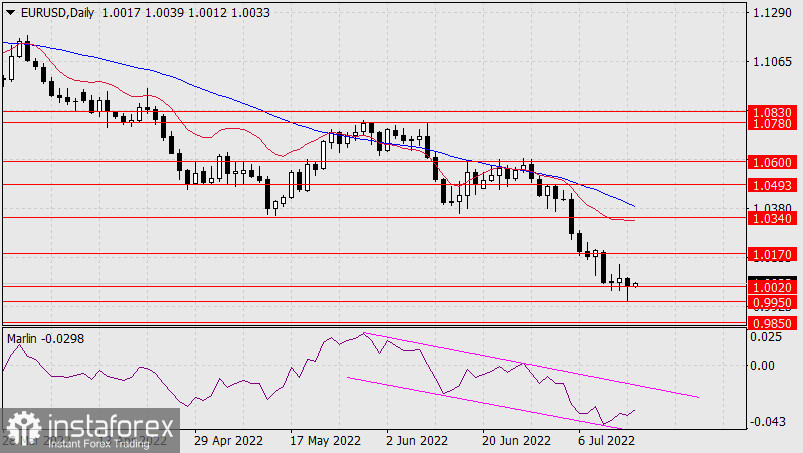

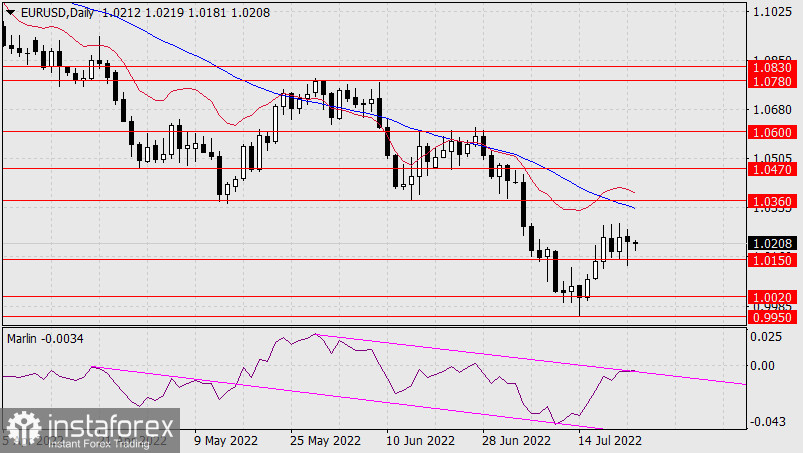

Yesterday, the euro fulfilled its task - it reached the target support of 0.9950. But the price did not settle under 1.0020 on a daily scale. The signal line of the Marlin Oscillator, having turned up from the lower border of its own descending channel, continues to grow.

Tension is being created on the market, which may turn into a corrective growth up to 1.0170. Visually, at this moment, the oscillator line will touch the upper border of the channel. If the movement of the price and the oscillator are synchronized by that moment, we expect a reversal into a new downward wave from 1.0170. If the price can overcome the support at 0.9950 immediately, then the next target will be the level of 0.9850.

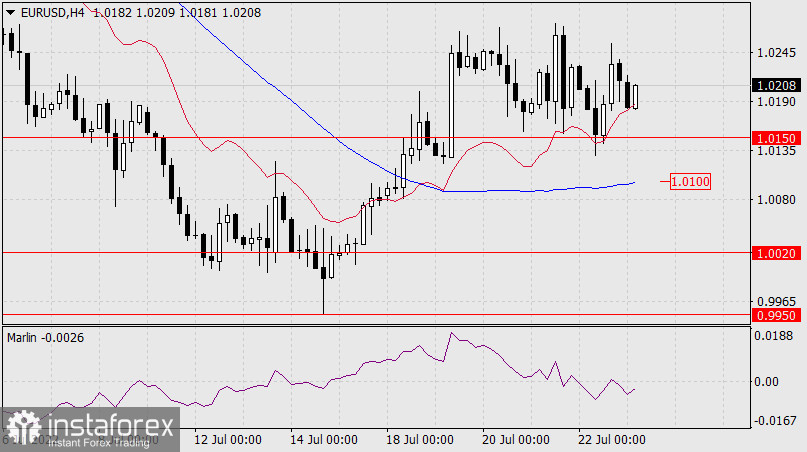

The H4 chart also shows the tension and ambiguity of the situation. The Marlin Oscillator took a neutral state near the zero line, the price returned to the consolidation range on the 12th-14th. It is possible that a full-fledged correction will not take place, the growth can be stopped by the MACD indicator line (1.0105), then the price stop at 1.0020 will continue in the form of a normal consolidation. In this situation, it is advisable to wait a bit, perhaps wait out the correction in order to resume short positions with less risk.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex.

Read More

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks