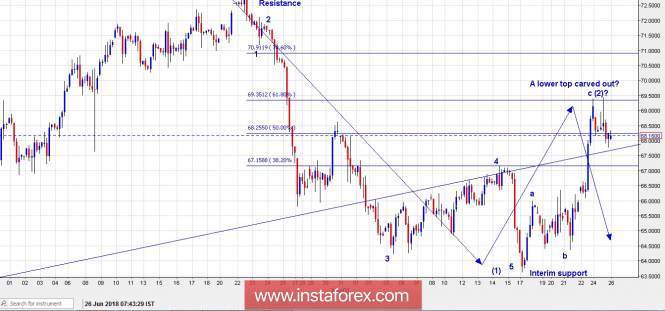

Elliott wave analysis of EUR/NZD for June 22, 2018

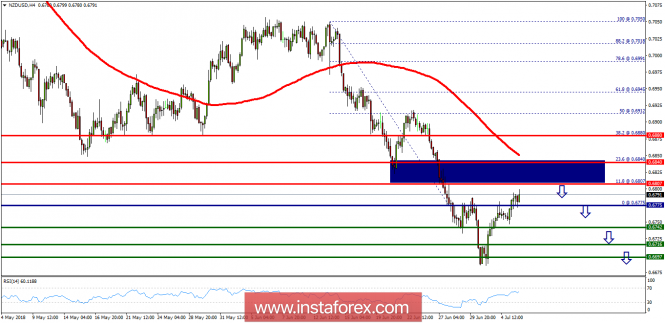

The minor correction we expected from 1.6921 moved slightly lower than expected and spiked down to 1.6806, but that does not change our outlook for a new impulsive rally soon towards 1.7133 and above.

Short-term, we could see another minor spike to near 1.6806 before the next move higher should be expected.

Only an unexpected break below support at 1.6737 will question our bullish outlook.

R3: 1.7025

R2: 1.6964

R1: 1.6933

Pivot: 1.6890

S1: 1.6837

S2: 1.6784

S3: 1.6737

Trading recommendation:

We are long EUR from 1.6815 with our stop placed at 1.6730. If you are not long EUR yet, then buy near 1.6806 or upon a break above 1.6933 and use the same stop at 1.6730.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided byInstaForex.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks