Forex Analysis & Reviews: Forecast for EUR/USD on August 1, 2022

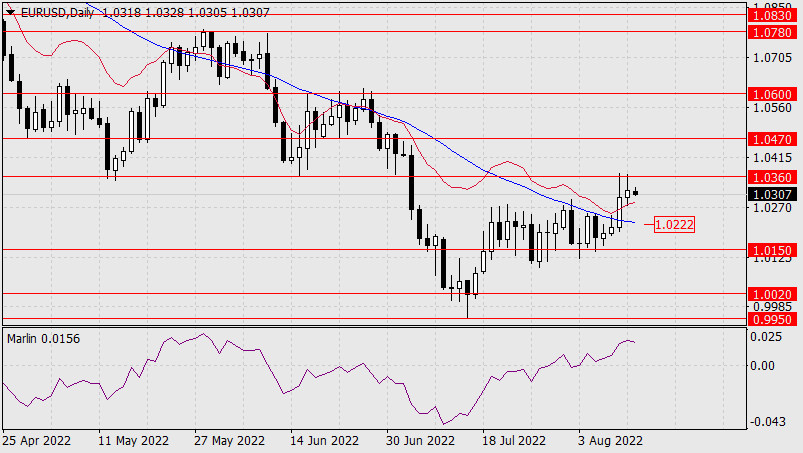

By this morning, the euro's situation is such that over the past four days the price has not overcome the support level of 1.0150, the downward potential was lost, and now the price is growing towards the nearest target of 1.0285 supported by the Marlin Oscillator growing in the positive area on the daily scale chart.

Breaking the MACD line (1.0285) will open the target level of 1.0360 (the June 15 low). From this level, the probability of a price reversal down, into a medium-term decline, will increase by a lot.

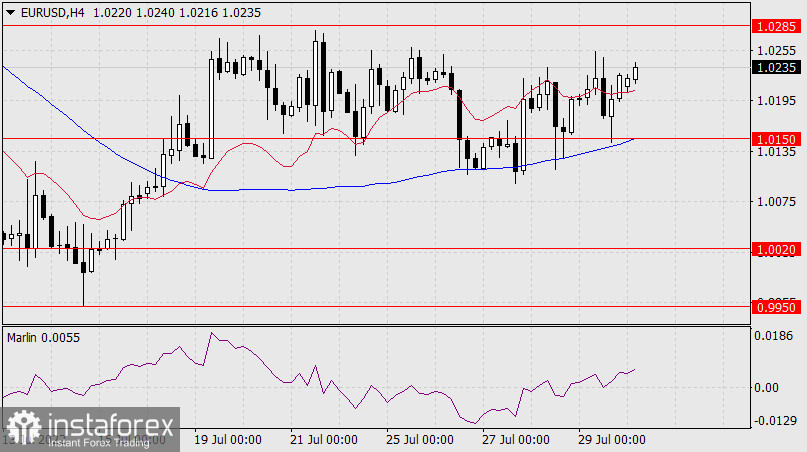

On the H4 chart, it is noticeable that a four-fold upward price reversal occurred from the MACD indicator line. At the moment, the price is rising above the balance line, the Marlin Oscillator is growing in the upper half - in the territory of an upward trend.

The final estimates of the eurozone Manufacturing PMI for July will be published today, the forecast for it is unchanged at 49.6, as well as for the US ISM Manufacturing PMI, for which the forecast is already down: 52.0-52.3 against 53.0 a month earlier. We are waiting for the continuation of the euro's corrective growth.

Analysis are provided by InstaForex.

Read More

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks