Technical analysis: Intraday Level For EUR/USD for December 17, 2018

Company does not offer investment advice and the analysis performed does not guarantee results

When the European market opens, some economic data will be released such as Empire State Manufacturing Index, Trade Balance, Final Core CPI y/y, Final CPI y/y, and Italian Trade Balance. The US will also release the economic data such as TIC Long-Term Purchases, NAHB Housing Market Index, and Empire State Manufacturing Index, so amid the reports, the EUR/USD pair will move in a low to a medium volatility during this day.

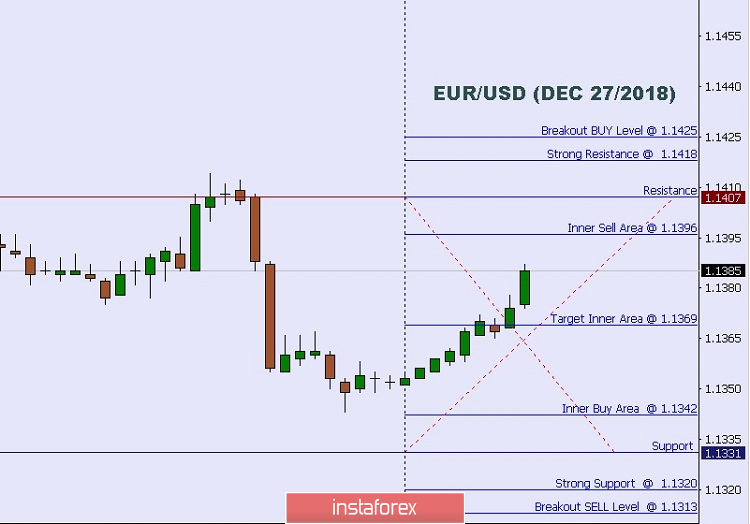

TODAY'S TECHNICAL LEVEL:

Breakout

BUY Level: 1.1362.

Strong Resistance: 1.1355.

Original Resistance: 1.1344.

Inner Sell Area: 1.1333.

Target Inner Area: 1.1306.

Inner Buy Area: 1.1279.

Original Support: 1.1268.

Strong Support: 1.1257.

Breakout SELL Level: 1.1250.

Disclaimer: Trading Forex (foreign exchange) on margin carries a high level of risk, and may not be suitable for all Traders or Investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Analysis are provided byInstaForex.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks