Technical analysis of ETH/USD for 28.05.2019

Crypto Industry News:

One of the largest peer-to-peer cryptocurrencies, LocalBitcoins.com, has banned users living in Iran, according to information published on the company's website.

The source previously informed the financial media in an e-mail that the impulse to limit Iranian transactions was to comply with financial regulations in Finland, where the headquarters of LocalBitcoins.com is located. In addition, the stock exchanges allegedly cut off users from Iran because of sanctions previously imposed on other exchanges by the United States.

Coinbase and Binance cryptocurrency exchanges do not currently support users residing in Iran as well.

Technical Market Overview:

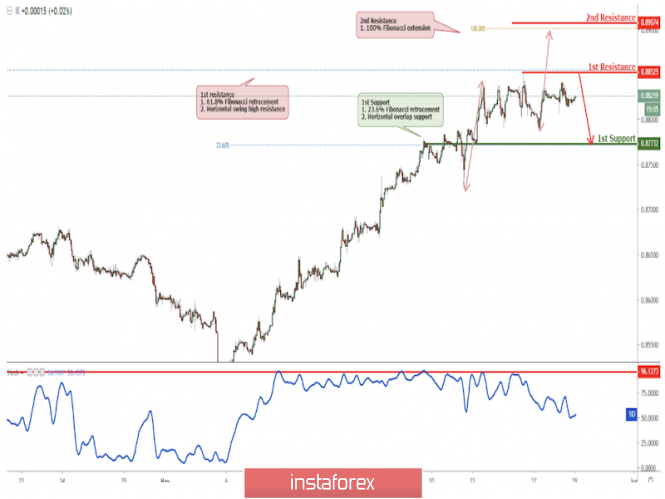

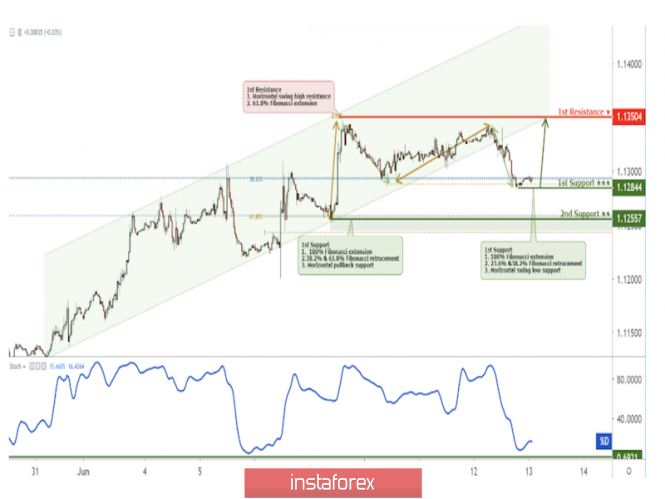

The ETH/USD pair might have completed wave (4) and now the market is unfolding the wave (5) to the upside, but the momentum behind the move up is still low. The target for this wave is seen at the level of $304. For now, the market is consolidating the recent gains in a narrow range between the levels of $278.14 - $263.42 as the market participants wait for the breakout.

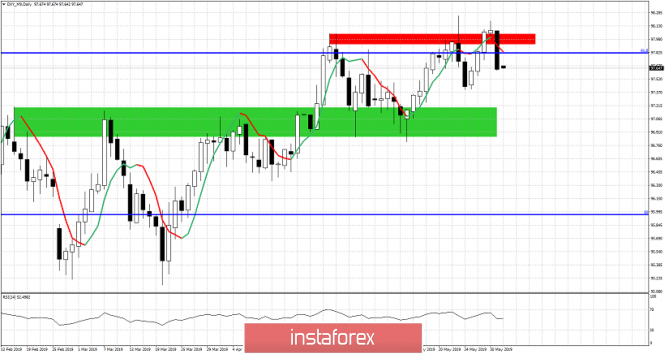

Weekly Pivot Points:

WR3 - $321.20

WR2 - $292.77

WR1 - $283.99

Weekly Pivot - $254.33

WS1 - $241.65

WS2 - $213.82

WS3 - $203.55

Trading Recommendations:

The best trading strategy in the current market conditions is to buy the local pull-back as wave 4 is in progress in anticipation of the wave 5 to the upside. Please pay attention to the technical resistance at the level of $278.14 as any breakout above this level is bullish. On the other hand, any violation of the level of $226.17 will accelerate the sell-off towards the next technical support at the level of $212.12.

Analysis are provided byInstaForex.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks