GBP/USD. Early elections in Britain: intrigue persists - Liberal Democrats put forward a counter demand

The European Union granted Great Britain an extension of Brexit. Despite the "traditional" resistance of the French, Brussels agreed to prolong the negotiation process until January 31, 2020. However, the British do not have to wait for the final date: the postponement is flexible, so London can prematurely initiate the completion of the Brexit procedure. But for this, the deputies of the House of Commons need to support the proposed draft deal with the EU. Fulfillment of this condition is the most difficult stage of the negotiation process. That is why the pound almost ignored today's decision of the Europeans. If Paris continued to block the deferral agreement, the GBP/USD pair would accordingly continue the downward movement. But by and large, traders were sure that in the end Brussels would agree on this step, therefore, a positive verdict on this issue provided little support to the pair.

But the issue of holding early elections to the House of Commons excites the minds of traders. After all, the fate of the orderly Brexit is now completely in the hands of the British Parliament, the current composition of which, to put it mildly, is very unfavorable to the current prime minister. So, in the House of Commons there are 650 deputies, 294 of which are Conservatives. A few months ago, there were 315 Tory representatives, but Johnson expelled 21 deputies from the party for "political indiscipline" - they supported the law obliging him to ask Brussels for deferment of Brexit.

In order to overcome the threshold of a simple majority, the prime minister needs another 31 votes (provided that the Conservatives vote "yes"). The Tory's temporary ally is the Democratic Union Party — at the expense of their representatives, the Conservatives had a majority in Parliament. But this is in a "peaceful" time, while now the Unionists are also categorically against the approval of the deal. Other parties represented in the British Parliament - the Scottish National Party, the Greens and the Party of Wales - are long-standing opponents of the Conservatives in general and Boris Johnson in particular, so it will be extremely difficult for the prime minister to entice them to his side.

Meanwhile, a snap election in Britain could be called with the support of two-thirds of Parliament (434 MPs). Labour has twice blocked the government's initiative to hold elections, and this time also promised to vote in a similar way. According to the British press, Downing street is also discussing a "plan B": Johnson's supporters initiate a vote of no confidence in the government – after the completion of the two-week period, which is allotted for the formation of a new Cabinet, the Parliament "automatically" dissolves. In this case, Johnson will need a simple majority, but there are risks: for example, during the allotted 14 days, opposition parties can hypothetically unite around another leader, depriving the Conservatives of power.

Another way to early elections is to change the electoral law itself. However, any such bill can get bogged down in parliamentary discussions for a long time. Labour could amend the proposal to Johnson's disadvantage by adjusting the timing or procedure of the election. In addition, the opposition may delay consideration of the bill for a long time by introducing various amendments, for example, on the right to vote for 16-year-olds.

The first battles in the British Parliament on the issue of early elections ended in nothing today. On Monday, Labour again reaffirmed their position - they will not support Johnson's initiative. When the speaker put this issue to a vote, 299 deputies spoke in favor, which is 135 less than the required number.

But the Liberal Democrats announced that they would support early elections, but they did not propose holding them on December 12, but on December 9. At first glance, the difference of three days is not significant, but not in this case. The fact is that on December 9, students of most universities will still be in their educational institutions (and are more likely to take part in the elections). But on December 10-11, the Christmas holidays begin: many students may not wait for the end of the week and will leave for a vacation. Libdems are popular among young people, so this nuance has strategic importance for them. Boris Johnson announced that he would discuss the proposal of Liberal Democrats, after which the parliament would return to this issue again - most likely, on Tuesday.

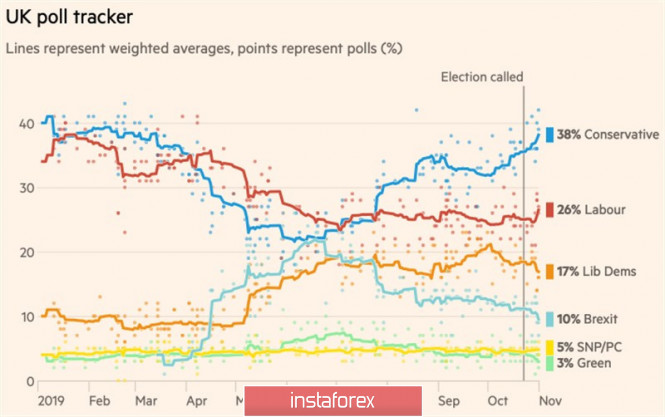

It is worth noting that a survey conducted from Wednesday to Friday last week showed that Conservative support reached 40%, while Labour remained at the same level - 24%. Compared with the survey the week before last, Tory support grew by 3%, but the result of the Labour Party did not change. Liberal Democrats, in turn, received 15% support in the latest poll, and Nigel Farage's Brexit party received 10%. All this suggests that following the results of early elections, Johnson will be able to form a majority in the House of Commons and, accordingly, agree on a deal with Brussels.

Thus, the first round of the struggle for elections ended to no avail. At the same time, the intrigue in this matter still persists, especially amid the prolongation of the negotiation process until January 31 and the position of Liberal Democrats.

Analysis are provided byInstaForex.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

. "Stay in the cache" - believe me - far from the worst option in trading. After all, the main task in trade is to save a deposit.

. "Stay in the cache" - believe me - far from the worst option in trading. After all, the main task in trade is to save a deposit.

Bookmarks