Technical analysis of ETH/USD for 02/10/2019

Crypto Industry News:

Testnet network Ethereum under the name Istanbul (which operates under the Ropsten testnet) was launched on September 30. Considering the existing problems related to the dates of the planned hard forks, this can be considered a great success. The whole was able to run even two days before the earlier announced date, which fell on October 2.

Unfortunately, after the activation of Ropsten an unplanned fork occurred. So now two chains are working.

The issue of the community centered around the Vitalik Buterin platform was explained by the community manager at the Ethereum Hudson Jameson Foundation. In his tweet from yesterday, he described what happened. Today, some miners are still mining the old version of Ropsten. Another copy of its new, updated version. The programmer, however, calms down. The problem is to be solved. Information should not worry investors: they are testnets, so that such errors come out during their duration.

Jameson also explains what exactly happened. The genesis of the problem is the nature of blockchains based on the proof-of-work algorithm, including Ethereum. The miners in them must independently update the software to be able to dig as part of a new chain. This time some of them did not and the result was an unplanned division.

Technical Market Overview:

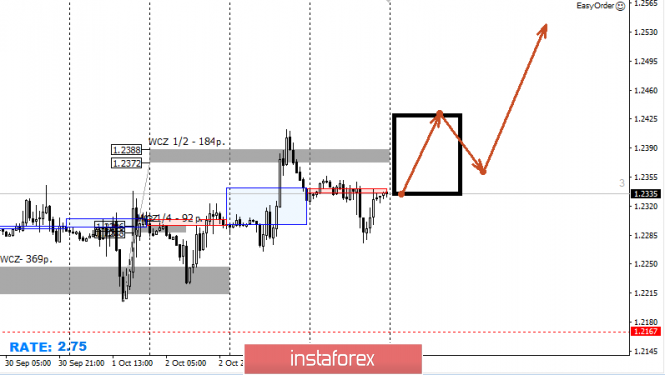

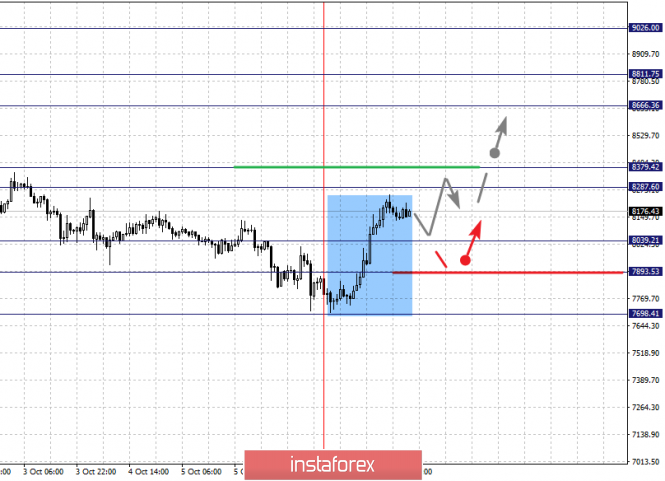

The ETH/USD pair has made a new local high at the level of $185.05, but so far couldn't make it to the 50% of Fibonacci retracement located at the level of $187.37. The supply zone located between the levels of $172.82 - $176.66 has been clearly broken, the momentum is now increasing significantly, so there is a chance for the bulls to hit the level of 50% of even the 61% shortly if the trendline dynamic support around the level of $172.82 will provide the bounce. In the case of a trendline violation, the nearest technical support is located at the level of $163.98.

Weekly Pivot Points:

WR3 - $256.80

WR2 - $233.68

WR1 - $197.61

Weekly Pivot - $174.45

WS1 - $137.03

WS2 - $112.52

WS3 - $77.73

Trading Recommendations:

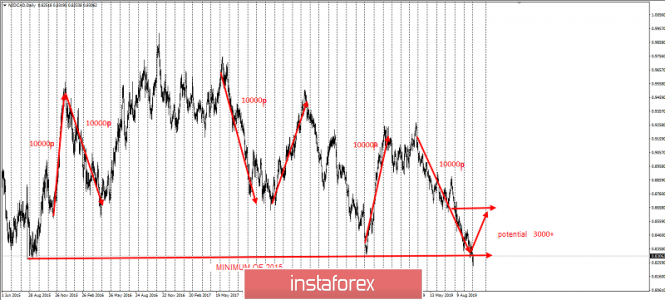

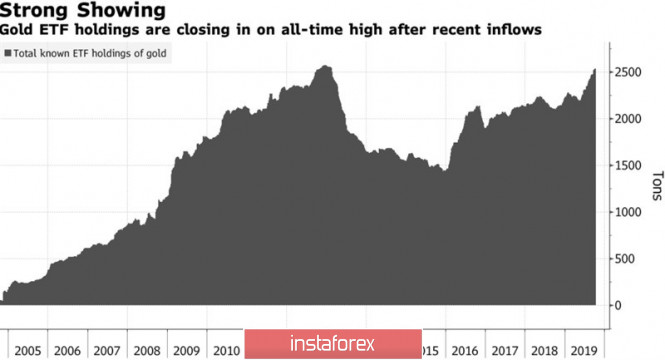

The best strategy in the current market conditions is to trade with the larger timeframe trend, which is still up. All the shorter timeframe moves are still being treated as a counter-trend correction inside of the uptrend. When the wave 2 corrective cycles are completed, the market might will ready for another impulsive wave up of a higher degree and uptrend continuation

Analysis are provided byInstaForex.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks