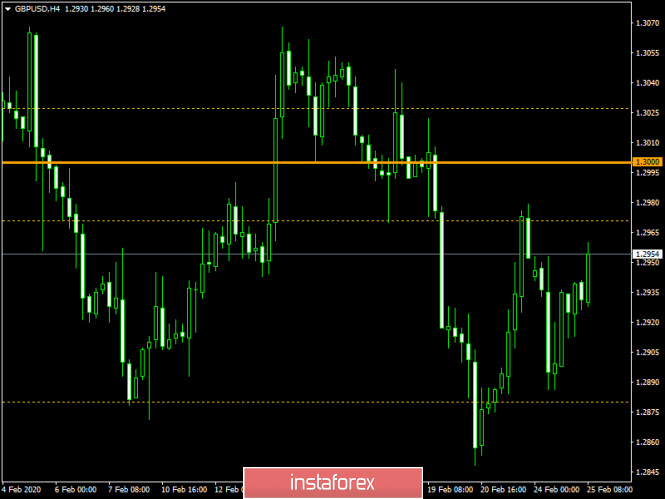

Technical analysis of GBP/USD for 24/02/2020

Technical Market Outlook:

The GBP/USD pair rallied through all the near technical resistance levels located at 1.2871, 1.2904, 1.2939 and 1.2962, but eventually, bulls did not make it through the technical resistance located at the level of 1.2988. The market had made a Bearish Engulfing candlestick pattern around this level and the bears took control over the market. Currently, the price is coming off the hight and traders around the level of 1.2939. The larger timeframe trend remains up, but the recent breakout from the consolidation zone is a signal, that the uptrend might be reversed soon.

Weekly Pivot Points:

WR3 - 1.3255

WR2 - 1.3152

WR1 - 1.3043

Weekly Pivot - 1.2942

WS1 - 1.2840

WS2 - 1.2740

WS3 - 1.2640

Trading recommendations:

The best strategy for current market conditions is to trade with the larger timeframe trend, which is up, so all downward market moves will be treated as local corrections in the uptrend. In order to reverse the trend from up to down in the longer term, the key level for bulls is seen at 1.2756 and it must be clearly violated. The key long-term technical support is seen at the level of 1.2231 - 1.2224 and the key long-term technical resistance is located at the level of 1.3512.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks