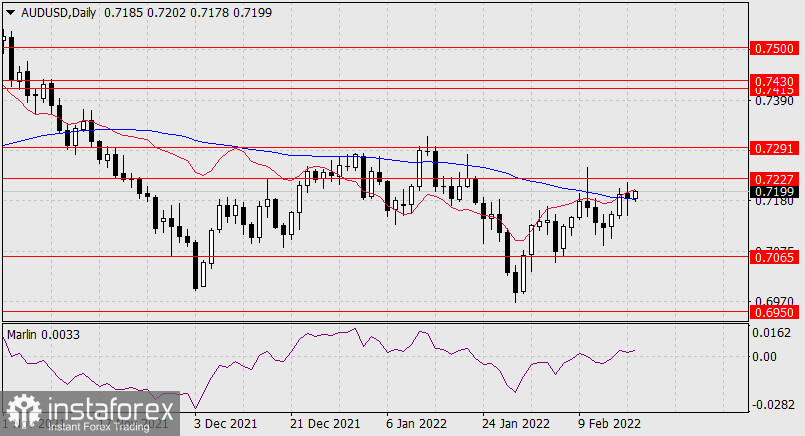

Forex Analysis & Reviews: Forecast for AUD/USD on February 8, 2022

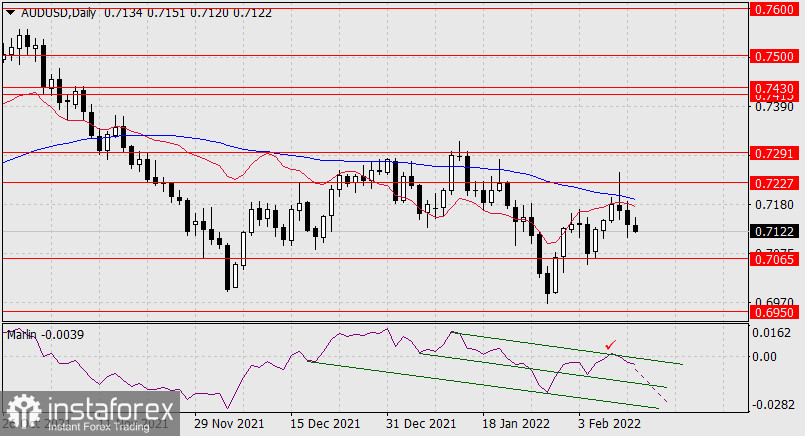

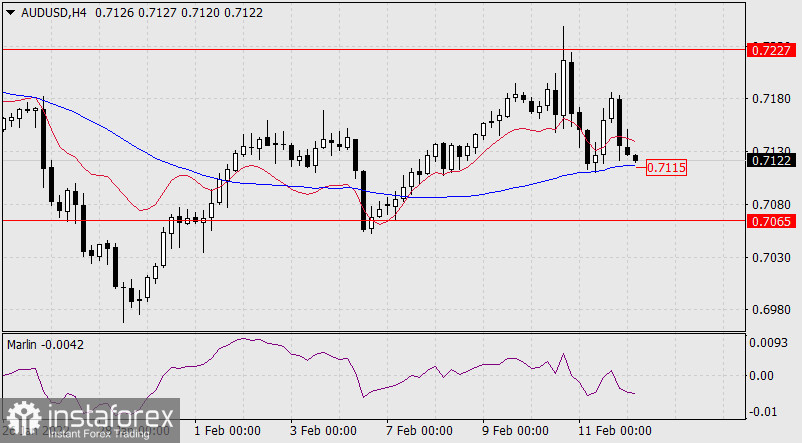

As of this morning, the growth situation looks unambiguous for the Australian dollar. The price turned up from the target level of 0.7065 supported by a strong price convergence with the Marlin Oscillator on the daily scale chart. The first growth target is 0.7190, the second target is 0.7227, the third target is 0.7291 – the low of July 2021. A price delay is likely in the 0.7190-0.7227 range, since the MACD line is located in it.

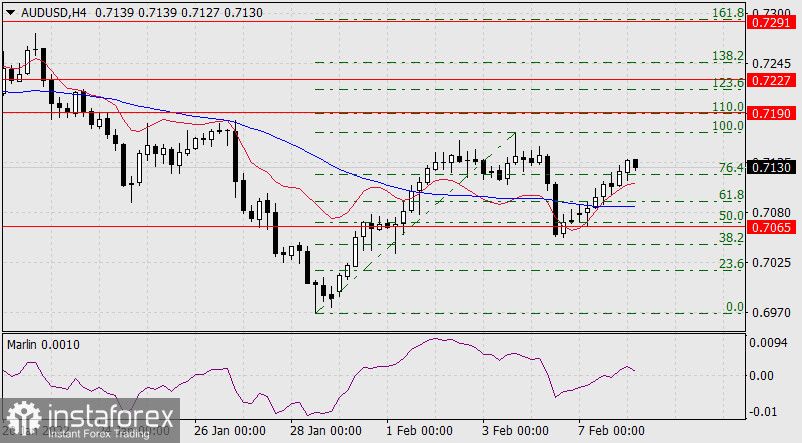

On the four-hour chart, the price is above both indicator lines, the Marlin Oscillator is in the upward trend zone. It is interesting to note here that the targets at 0.7190 and 0.7291 coincide with the 110.0% and 161.8% Fibonacci levels. The 0.7291 target will probably be fulfilled. It is likely to be corrected.

Analysis are provided byInstaForex.

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks