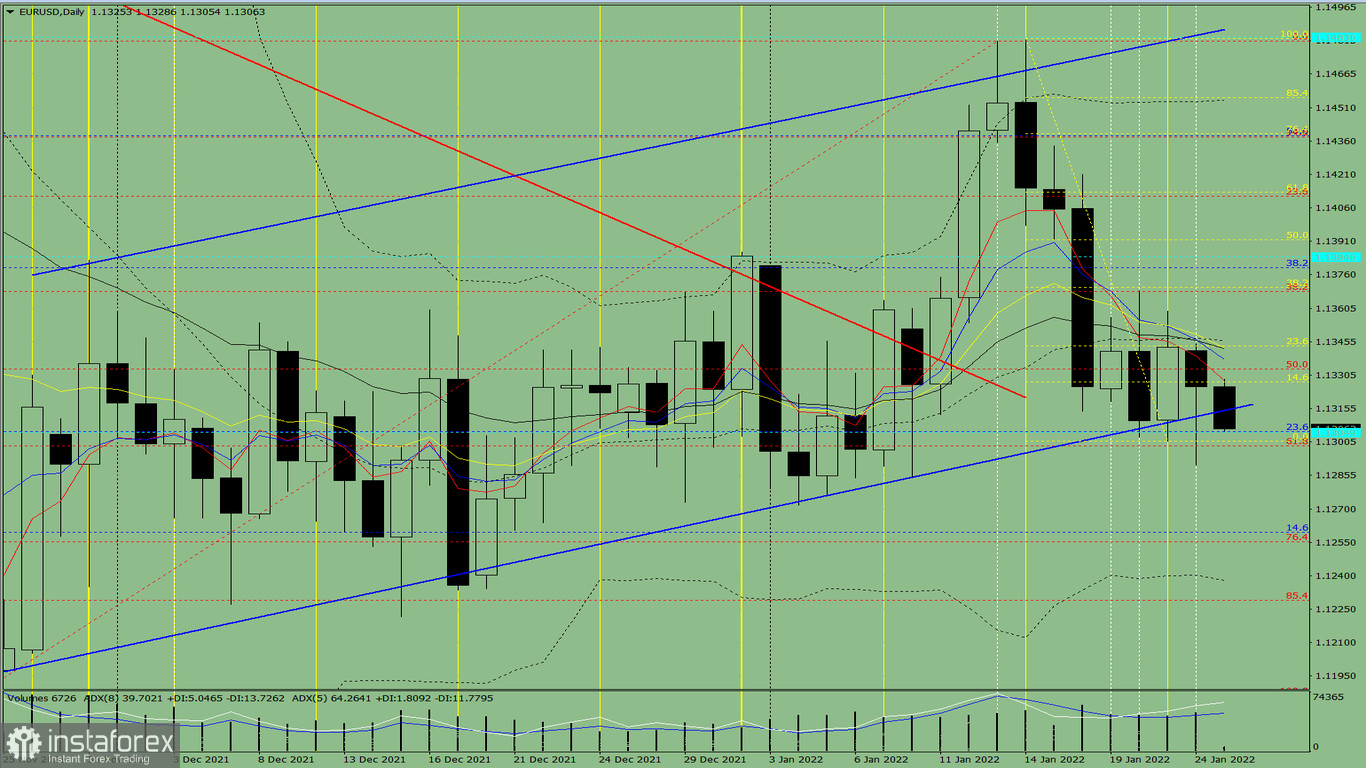

Forex Analysis & Reviews: Indicator analysis. EUR/USD daily review on January 25, 2022

Trend analysis (Fig. 1) EUR/USD is likely to decline on Tuesday, from 1.1326 (closing of yesterday's daily candle) to 1.1299, which is the 61.8% retracement level (red dotted line). After that it will return to the 14.6% retracement level at 1.1327 (yellow dotted line), then go further upwards.

Fig. 1 (daily chart)

Comprehensive analysis:

Indicator analysis - downtrend

Fibonacci levels - downtrend

Volumes - downtrend

Candlestick analysis - downtrend

Trend analysis - uptrend

Bollinger bands - downtrend

Weekly chart - uptrend

Conclusion: EUR/USD will dip from 1.1326 (closing of yesterday's daily candle) to the 61.8% retracement level at 1.1299 (red dotted line), then go to 1.1327, which is the 14.6% retracement level (yellow dotted line). It may go further up after reaching that level.

Alternatively, the pair could move from 1.1326 (closing of yesterday's daily candle) to the lower fractal at 1.1290 (daily candle from 01/24/2022), then climb further to 1.1327, which is the 14.6% retracement level (yellow dotted line).

Analysis are provided byInstaForex.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks