The dollar weakens against the backdrop of political threats

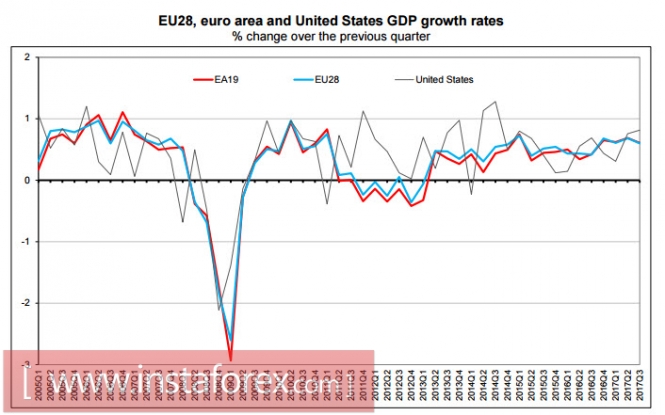

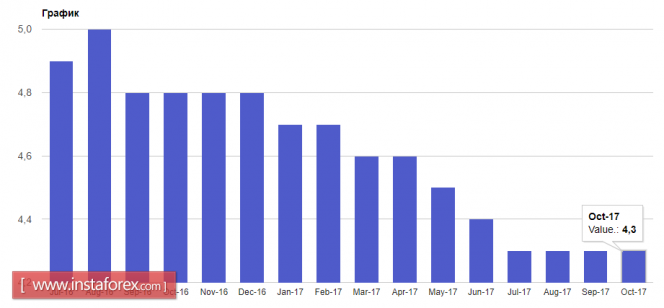

Adjusted data on US GDP in the third quarter were better than expected, the growth rate was revised to 3.3%, and by all means, the US economy is recovering successfully. This is despite the fact that the Congress has not yet approved the draft of the tax reform.

However, the main factor of positive growth is not so much the growth of the economy as the growing consumer activity. According to the updated data, in the third quarter, the personal consumption expenditure index was 1.4%, and not 1.3%, as previously reported. This was released the day after the data on personal incomes in October also outperformed forecasts, with growth at 0.4% against expectations of 0.3%.

The market reacted positively to the reports, while the data on business activity in the manufacturing sector released by ISM on Friday made it possible to revise the forecast for US GDP in the fourth quarter to reach 3.5%, reflecting generally confidently positive expectations.

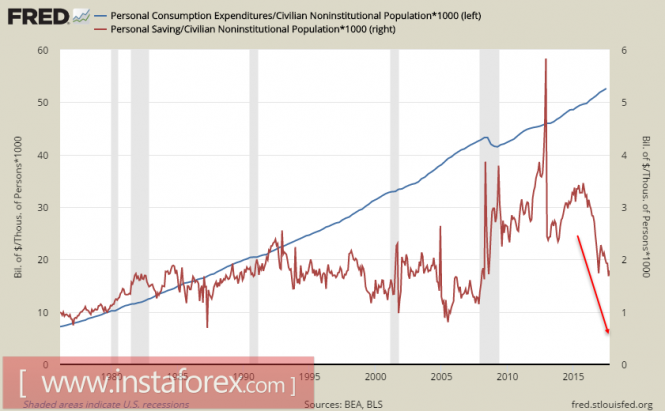

At the same time, it should be noted that the positive dynamics of consumer activity is not due to fundamental changes. The simplest calculations show that the growth of expenses is not based on revenue growth, but on the growth of lending, which in turn reflects certain hopes associated with the future tax reform. The growth of expenses in terms of the potentially able-bodied population is growing steadily, while personal savings are falling and have already reached the pre-crisis level of 10 years ago.

Thus, a certain revival of the consumer sector is associated with hopes for a reduction in tax pressure. If, however, the approval of the reform program in the Congress faces difficulties, then in this case one can expect a sharp decline in consumer activity and an increase in deflationary expectations.

The grounds for such fears are: On Friday, the Senate postponed the vote on the tax reform, the stumbling block was the report of the Tax Committee, from which it follows that the reform will not lead to filling the budget and the deficit will remain at the level of at least $1 trillion in a 10-year perspective. The economic analysis of the tax reform plan by the Minister of Finance Mnuchin has not yet been released. Therefore, the financial effect of the reforms may not be the same as the government represents. Before the markets closed on Friday, the final vote in the Congress did not take place, which ultimately contributed to the depreciation of the dollar.

Another reason for the fall of the dollar is that former adviser to Donald Trump, Michael Flynn, who was accused earlier of providing false information to the FBI, is prepared to testify against Donald Trump. If this news is confirmed, the opponents of Trump will have good reasons for initiating the impeachment procedure, which will automatically put an end to the tax reform program.

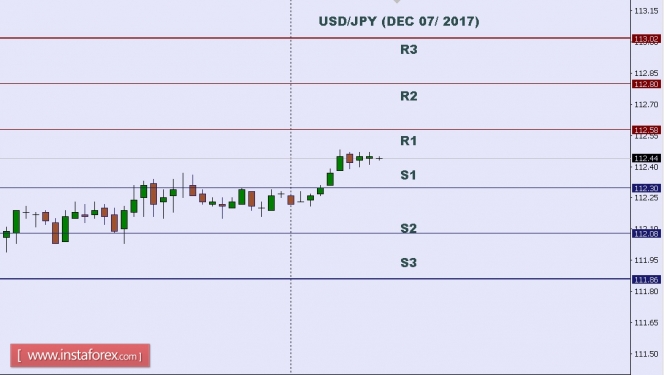

This scenario can lead to a rapid reduction in inflation expectations and will call into question the possibility of the Fed to implement the outlined plan for the growth rate in 2018, and the dollar will drop sharply against the yen and the euro. Fears remain hypothetical, but the dollar is losing momentum.

On Monday, the dynamics of the dollar will be determined. First of all, by political news related to the passage of the tax plan through the Congress and the development of the situation with Flynn. Acceptance of the tax plan is of fundamental importance in the light of approaching the date of December 8. Namely, before this date, the law on financing state institutions due to borrowing is in force.

On Tuesday, the ISM report on business activity in the services sector will be published, after a rapid growth in August-October, a slight slowdown is expected, but the level of PMI will remain high and can support the dollar.

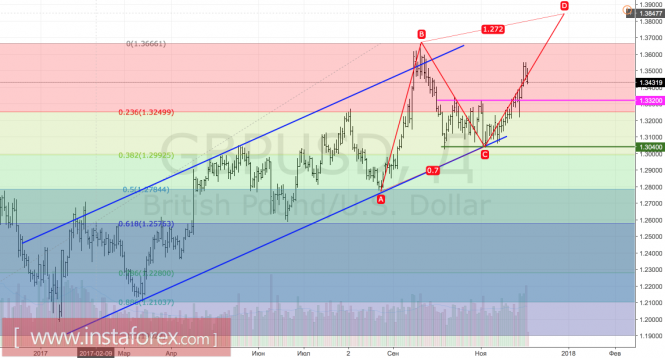

In general, the dollar remains the favorite, and any positive news can contribute to a new wave of buying. However, one must assume that the probability of a smooth phased solution of all the issues at the beginning of this week is not very high, and therefore the growth of the euro to 1.20 appears quite certain.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided byInstaForex.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks