Forecast for EUR/USD on February 10, 2020

EUR/USD

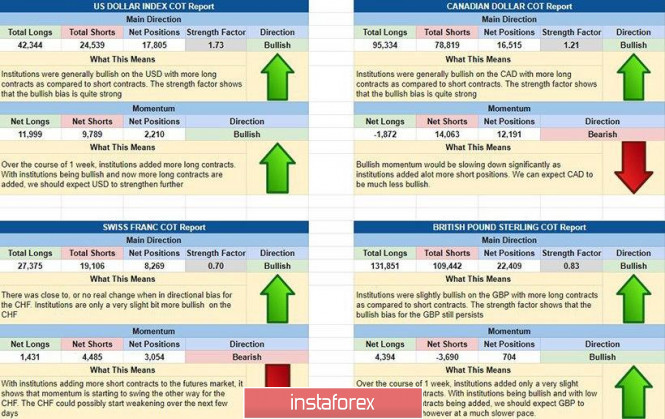

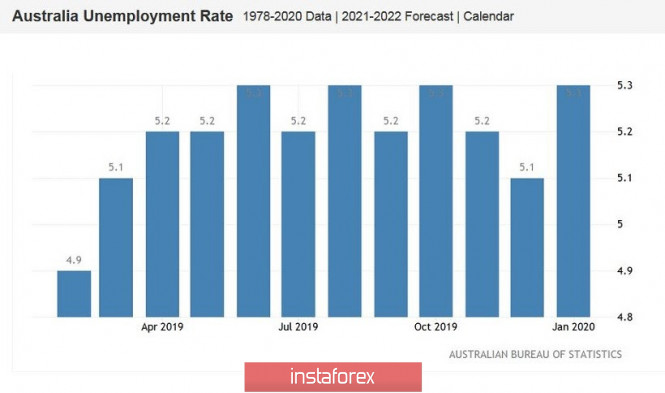

Friday's data on employment in the United States exceeded even optimistic forecasts; 225,000 jobs were created outside the agricultural sector in January against expectations of 163,000, the December figure was revised up to 147,000 from 145,000, the November Non-Farm Employment Change increased by 5,000, and the average hourly wage increased for the month by 0.2%. At the same time, the volume of consumer lending almost doubled – from 11.8 billion dollars to 22.1 billion. As a result, the euro fell by 36 points.

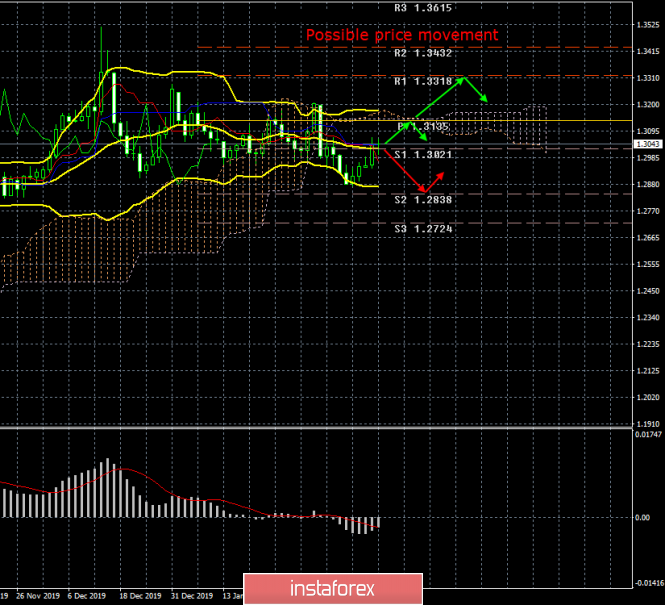

The reduction targets remain: 1.0925 - minimum on September 3 and 12, 2019, and 1.0880 - minimum on October 1.

On the four-hour chart, the signal line of the leading Marlin oscillator is directed upwards, which indicates that the indicator is likely to discharge and consolidate the price before a further decline.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks