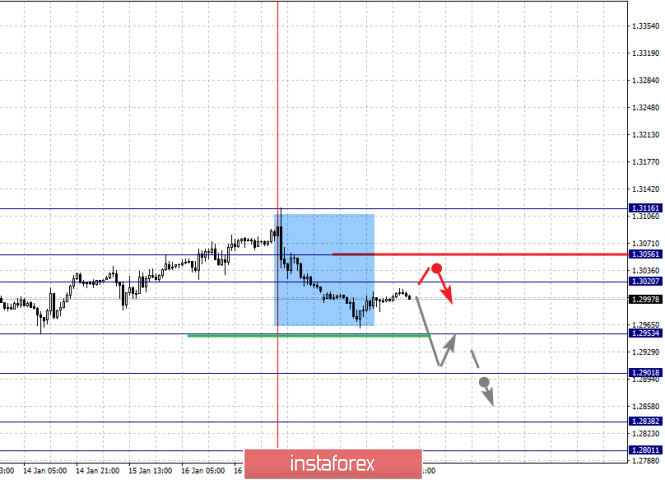

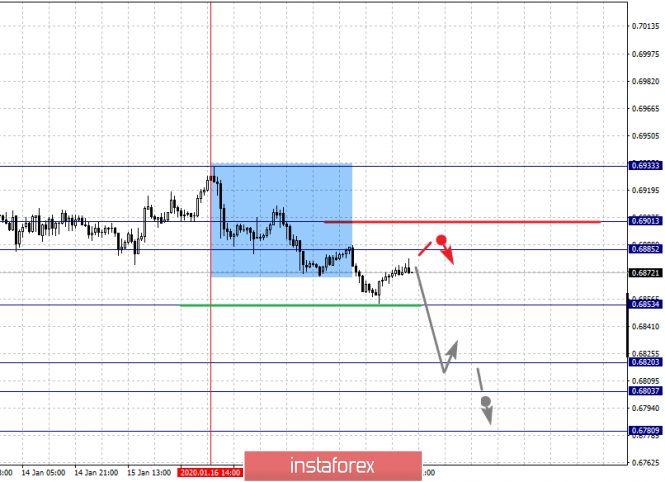

Forecast for GBP/USD on January 13, 2020

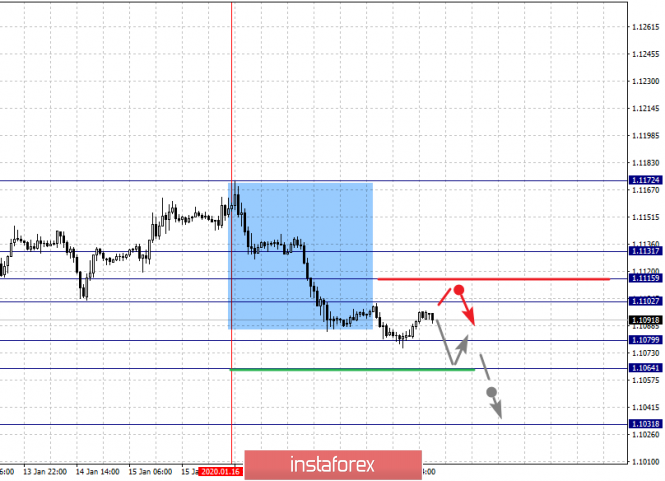

Quotes of the British pound are held for two days on the indicator line of the balance of the daily scale in red. Overcoming it will allow the price to consistently take the three immediate goals at the Fibonacci levels: 1.2968, 1.2820, 1.2730. The Marlin oscillator is in the decline zone.

On the four-hour chart, the price overcame the support of the MACD line, but did so with a gap. In this case, with a general declining trend and in the absence of warning reversal signals, the "window" serves as a harbinger of a further fall in prices, but it is not advisable for it to remain open for a long time.

We are waiting for the closure of this gap and a further decline in the British pound. The Marlin oscillator is developing in a declining trend zone.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks