Forex Analysis & Reviews: US shares higher at close of trade; Dow Jones up 0.55%

At the close in New York, the Dow Jones gained 0.55%, the S&P 500 rose 0.62% and the NASDAQ Composite rose 0.85%.

In the leaders of growth among the components of the Dow Jones at the end of today's trading were shares of Caterpillar Inc, which increased in price by 4.05 points (2.00%), to close at around 206.20. Dow Inc added 1.68% or 0.91 points to end trade at 55.14. Honeywell International Inc rose 1.67% or 3.38 points to close at 205.22.

The biggest losers were Visa Inc Class A, which fell 0.61% or 1.34 points to end the session at 216.62. Merck & Company Inc is up 0.56% or 0.43 points to end at 75.73 and Walmart Inc is 0.22% or 0.31 points down to 139. , 49.

The leaders of growth among the components of the S&P 500 at the end of today's trading were Tesla Inc, which rose 5.76% to 1.067.00, ViacomCBS Inc, which gained 4.80% to close at 30.58, and shares Micron Technology Inc rose 4.52% to end the session at 94.42.

The biggest losers were Coterra Energy Inc, which fell 1.82% to close at 19.39. Hologic Inc shed 1.42% to end the session at 76.12. Pfizer Inc was down 1.41% to 58.71.

The growth leaders among the components of the NASDAQ Composite index at the end of today's trading were shares of 22nd Century Group Inc, which rose 38.64% to the level of 3.050, Oncology Institute Inc, which gained 38.46%, to close at 10.44, and Pasithea Therapeutics Corp rose 36.73% to trade at 2.01 at the close.

The biggest losers were InnovAge Holding Corp, which fell 35.64% to close at 5.31. Jupiter Wellness Inc shed 24.89% to trade at 0.954. American Virtual Cloud Technologies Inc was down 24.00% to 1,900.

On the New York Stock Exchange, the number of securities that went up (2,289) exceeded the number of securities that closed in the red (971), while the quotations of 126 shares remained virtually unchanged. On the NASDAQ stock exchange 2679 companies rose in price, 1163 declined, and 181 remained at the level of the previous close.

The CBOE Volatility Index, which is based on S&P 500 options trading, fell 3.60% to 17.96, hitting a fresh monthly low.

Gold Futures for February delivery was up 0.42% or 7.65 to $ 1.809.85 a troy ounce. Elsewhere, WTI crude for February delivery rose 1.32%, or 0.96, to $ 73.72 a barrel. Futures contracts for Brent oil for March delivery rose 0.01%, or 0.01, to trade at $ 76.61 a barrel.

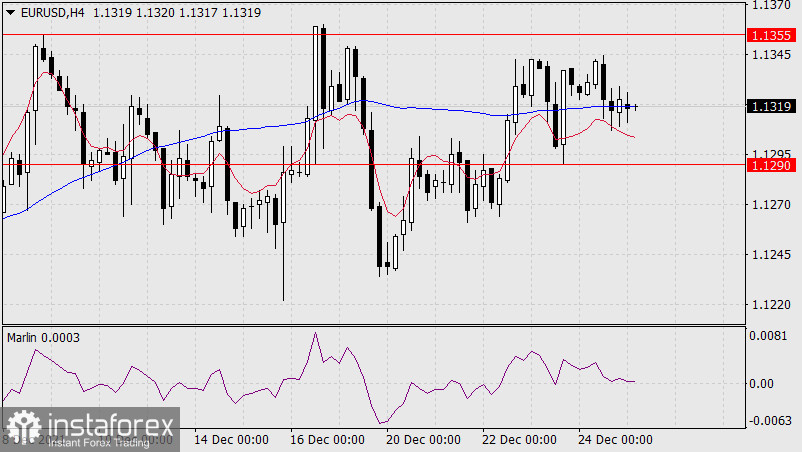

Meanwhile, on the Forex market, EUR / USD was up 0.03% to hit 1.1331, while USD / JPY was up 0.04% to hit 114.41.

The US Dollar Index Futures was down 0.02% at 96.035.

Analysis are provided byInstaForex.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks