Forex Analysis & Reviews: Technical Analysis of GBP/USD for May 18, 2022

Technical Market Outlook:

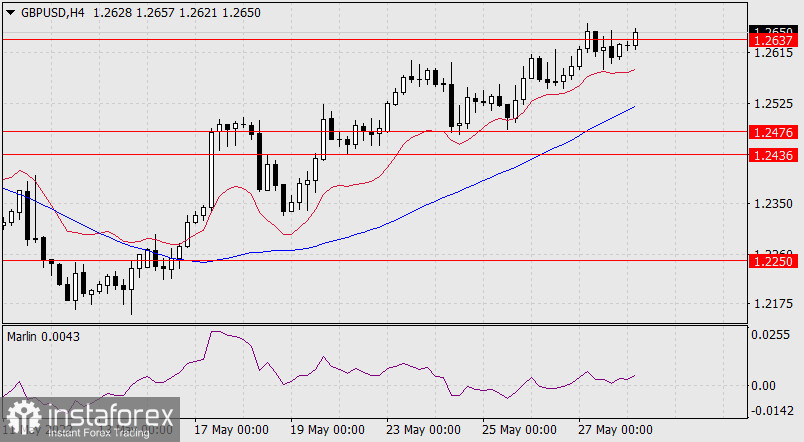

The GBP/USD pair has been seen bouncing from the swing low located at the level of 1.2155 and bulls had broken through the immediate intraday technical resistance at 1.2411. The technical resistance located at the level of 1.2484 is being tested currently, so any breakout through this level will open the road towards 1.2615 - 1.2697 zone. Despite the oversold market conditions on the H4 and Daily time frame charts there is no indication of trend termination or reversal just yet, so any move up must be seen only as a corrective cycle during the down trend. The bearish pressure will likely resume soon and the next technical support is seen at the level of 1.2165 and 1.2072.

Weekly Pivot Points:

WR3 - 1.2621

WR2 - 1.2514

WR1 - 1.2371

Weekly Pivot - 1.2267

WS1 - 1.2119

WS2 - 1.2008

WS3 - 1.1859

Trading Outlook:

The price broke below the level of 1.3000, so the bears enforced and confirmed their control over the market in the long term. The Cable is way below 100 and 200 WMA , so the bearish domination is clear and there is no indication of trend termination or reversal. The next long term target for bears is seen at the level of 1.1989. Please remember: trend is your friend.

Analysis are provided byInstaForex.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks