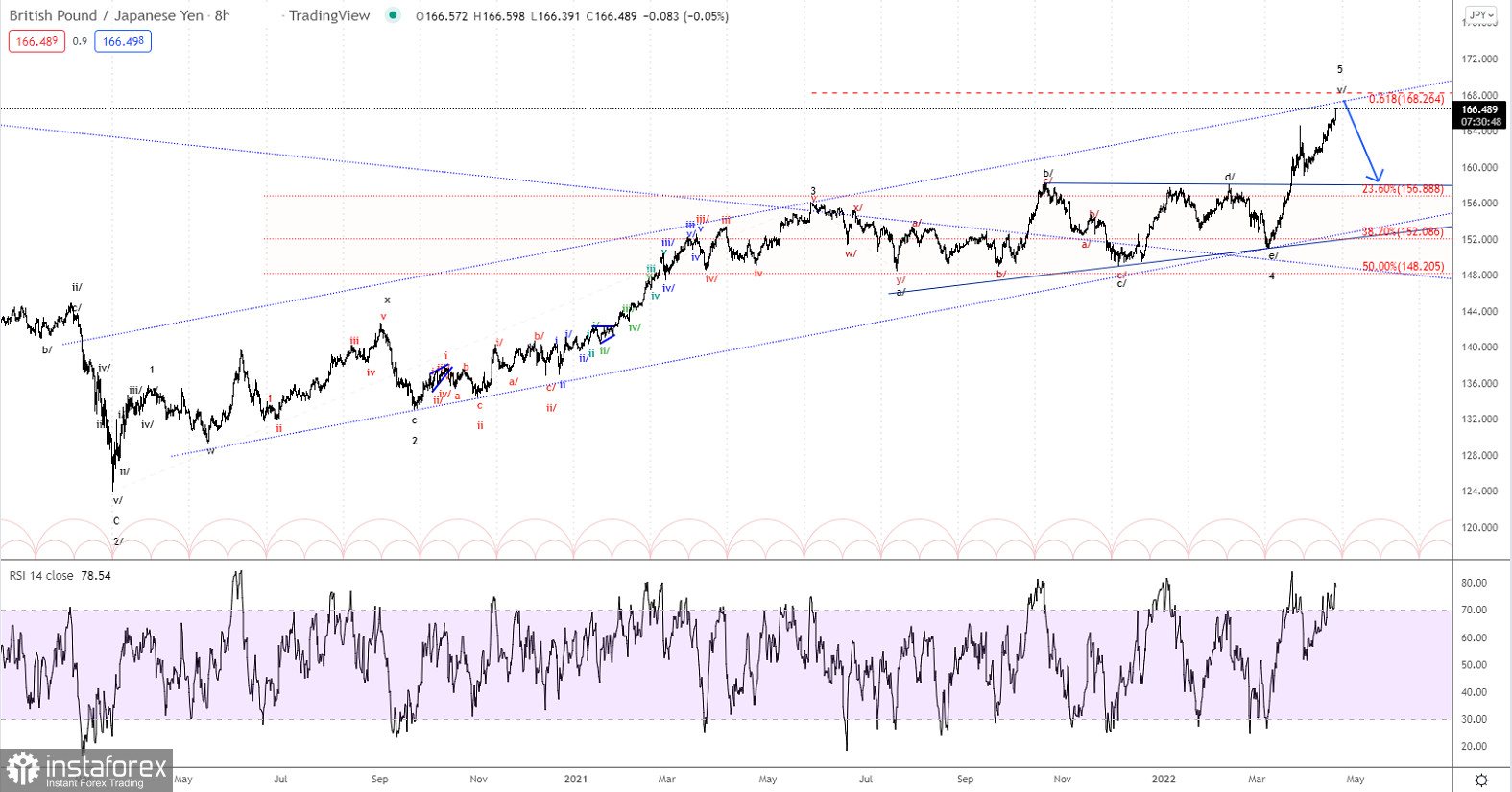

Forex Analysis & Reviews: Elliott wave analysis of GBP/JPY for April 19, 2022

As GBP/JPY has continue to make new highs for the rally since the 123.99 low we have reviewed our count. It's clearly possible to count a complete five wave rally from 123.99 to the present high at 166.60. What It also clear is that wave 4 is a triangle, which is normally a warning that the next impulsive rally will be the last of the total five wave sequence since the 123.99 low. That of course also means that the very best of the impulsive rally now is behind us and it's just a matter of time before GBP/JPY peaks and a larger corrective decline to 156.90 is seen.

We expect GBP/JPY to see its final peak at 168.26 where wave 5 will be 61.8% the length of wave 1 through wave 3.

Analysis are provided byInstaForex.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks