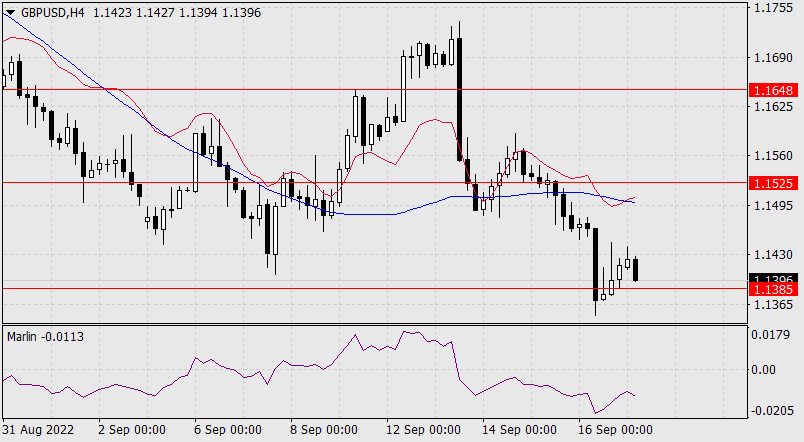

Forex Analysis & Reviews: Elliott wave analysis of GBP/JPY for September 12, 2022

GBP/JPY is getting absolutely nowhere. The most likely pattern unfolding here is a descending triangle as wave B/. We have apparently seen a top at 166.31 for renewed downside pressure towards the triangle support line near 160.00. A break below here will confirm the next decline towards 154.41.

Short-term a break below minor support at 164.19 will set the stage for a decline towards the triangle support line at 160.00. *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex.

Read More

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks