Forex Analysis & Reviews: Forecast for GBP/USD on September 26, 2022

The British pound fell by an incredible 417 points (-3.65%) on Friday, reaching strong support from the 1.0830 price level and price channel line of the monthly timeframe. This morning, during the first four hours of the trading session, the price fell by another 490 points in the moment, winning back half of the fall in the next half hour.

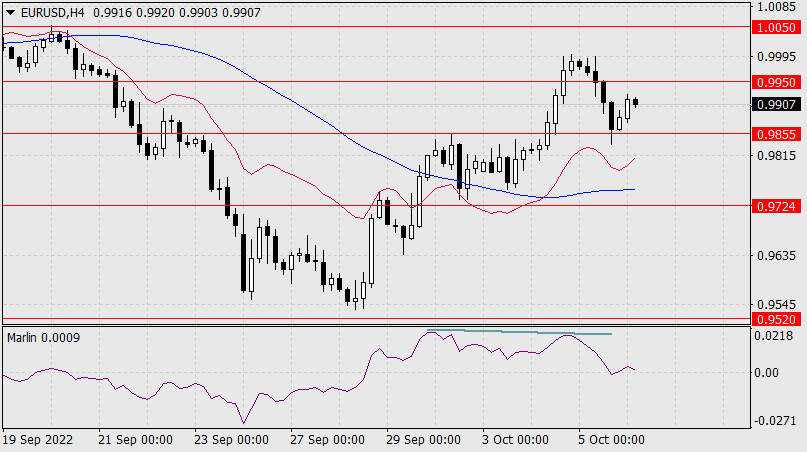

Now the price is between the target levels of 1.0310 and 1.0535. The Marlin Oscillator is in the oversold zone, the ultra-high volatility of the pound indicates its potential correction in the near future. The optimal strategy in this situation would be to wait for the correction to be completed and then open new short positions. The nearest target at 1.0310, formed by the embedded line of the price channel, remains unworked out. Leaving the area under it opens the 1.0140 target.

On a four-hour scale, the Marlin Oscillator is already headed for a correction - the price is consolidating under the level of 1.0535. We are waiting for the correction to be completed, the market to be calm, and the price to move down further.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided by InstaForex.

Read More

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks