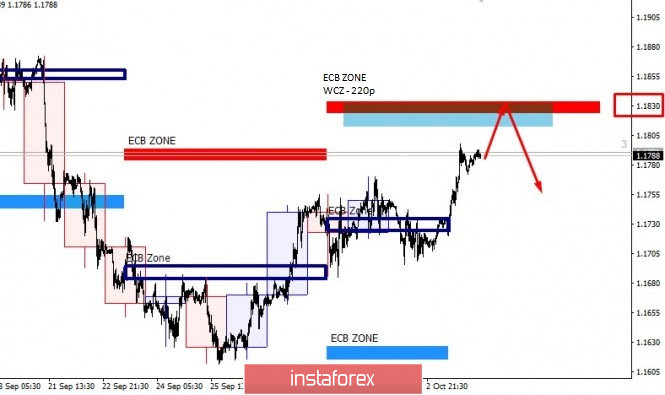

Technical Analysis of GBP/USD for September 28, 2020

Technical Market Outlook:

The GBP/USD pair has hit the level of 1.2697 (low was made at 1.2674) and after a short period of consolidation the market is starting to bounce. This corrective bounce higher should be capped very soon, because there is a wide supply zone located between the level of 1.2747 - 1.2869 and only a sustained breakout above the level of 1.2869 would indicate the whole corrective cycle termination. Moreover, the market is bouncing from the oversold conditions on the H4 time frame chart and the momentum is slowly accelerating as well. The weekly time frame trend remains up.

Weekly Pivot Points:

WR3 - 1.3187

WR2 - 1.3072

WR1 - 1.2894

Weekly Pivot - 1.2783

WS1 - 1.2601

WS2 - 1.2494

WS3 - 1.2312

Trading Recommendations:

On the GBP/USD pair the main, multi-year trend is down, which can be confirmed by the down candles on the monthly time frame chart. The key long-term technical resistance is still seen at the level of 1.3518. Only if one of these levels is clearly violated, the main trend might reverse (1.3518 is the reversal level) or accelerate towards the key long-term technical support is seen at the level of 1.1903 (1.2589 is the key technical support for this scenario).

Analysis are provided byInstaForex.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks