Forex Analysis & Reviews: Forecast for USD/JPY on November 26, 2021

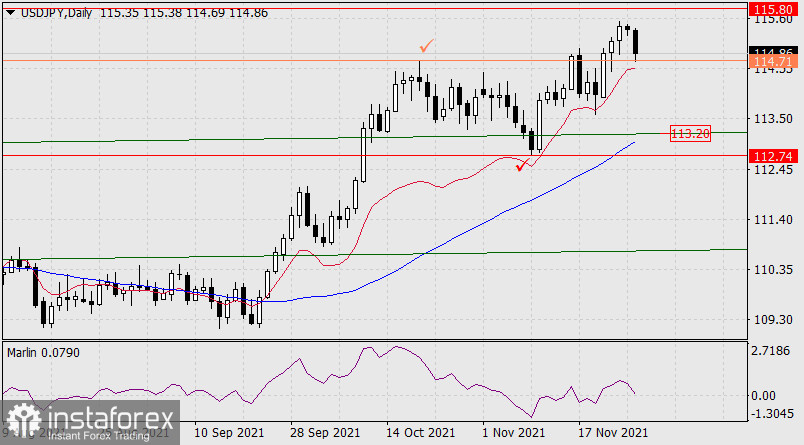

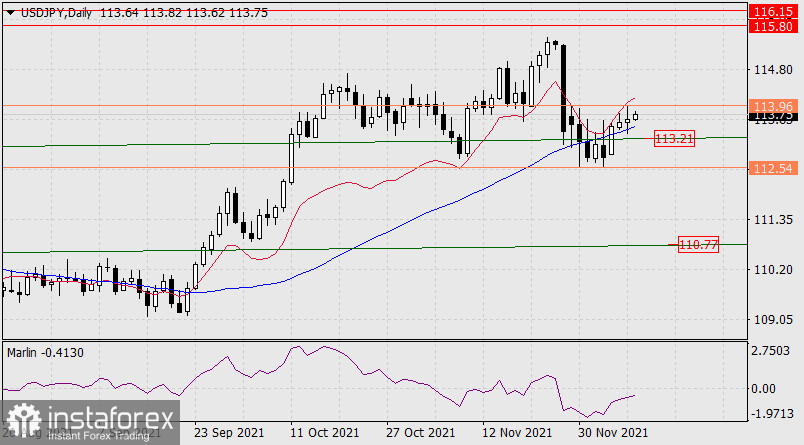

Yesterday, the dollar against the yen could not withstand the pressure from technical factors and this morning fell to the signal level of 114.71 (October 20 high). After the price drops below this level, the USD/JPY pair may continue to move to the magnetic point at 113.20 - to the point of intersection of the price channel line with the MACD line. The price can overcome the target, since below it is the second target level of 112.74, which is desirable for the bulls to work out if they intend to advance further - to create a false downward movement.

To complete the bearish picture, the signal line of the Marlin oscillator does not reach the negative area. Perhaps this will happen when the price goes below the signal level.

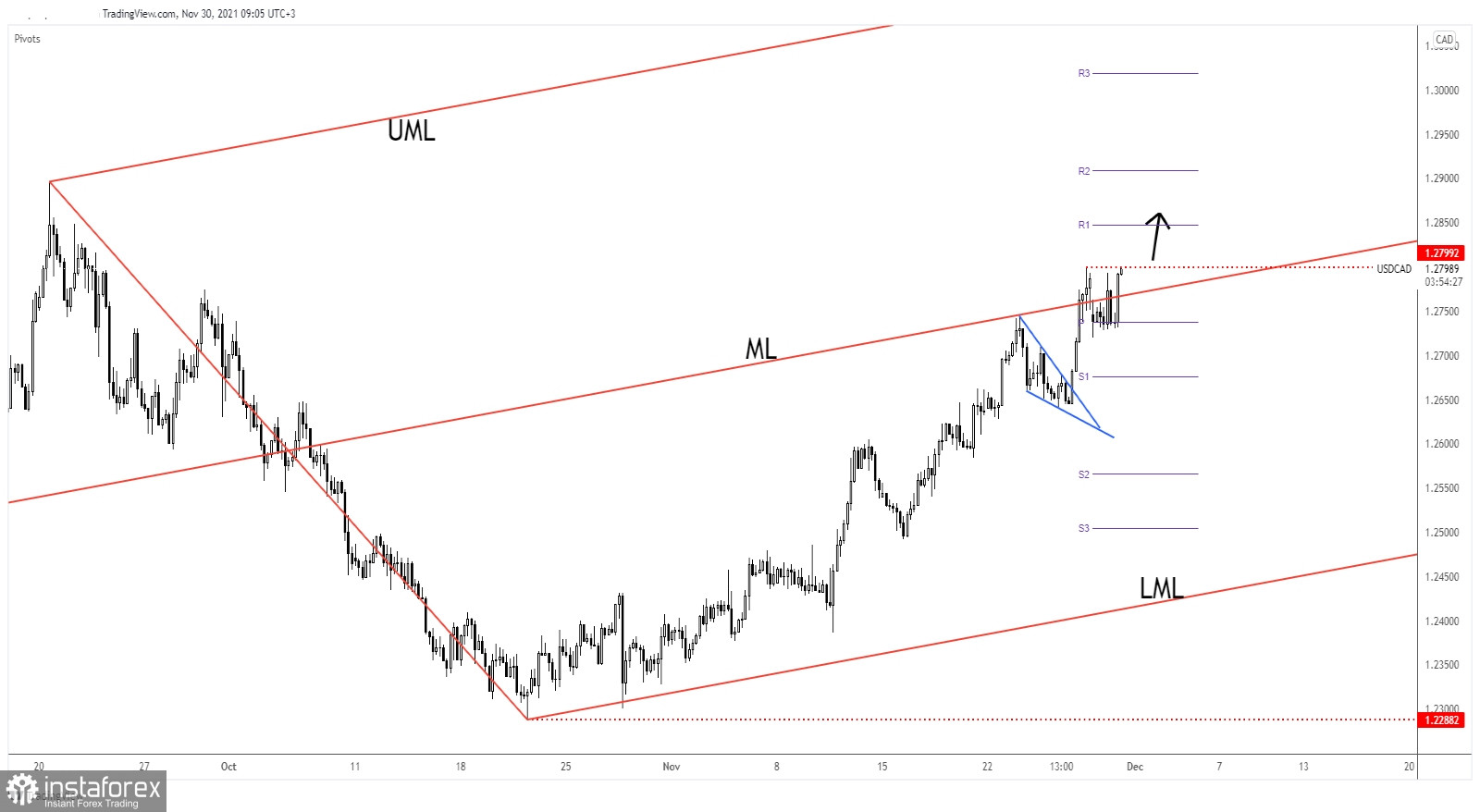

The price almost touched the MACD line on the four-hour chart. Settling below it, as well as below the level of 114.71, will become a condition for further price movement to the downside. The Marlin Oscillator is already in the negative zone.

Analysis are provided byInstaForex.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks