Forex Analysis & Reviews: Forecast for EUR/USD on October 29, 2021

The euro grew by 49 points on Thursday, but not on the basis of the European Central Bank meeting to determine the decision on the fate of PEPP in December, but on the disappointing US GDP for the third quarter, which amounted to 2.0% against the expected 2.6%.

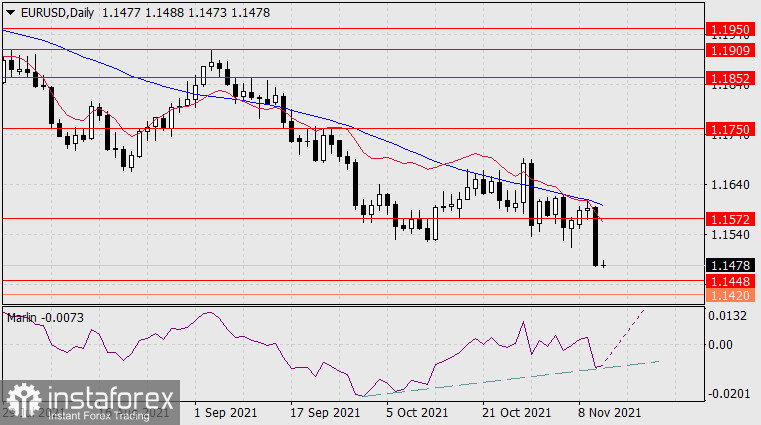

On the daily scale chart, the price crossed the balance and MACD indicator lines, as well as the signal level of 1.1669. Now the target is open at 1.1750 - resistance on September 21-24. Overcoming the level opens the second target at 1.1852, which is likely to be achieved, as investors paid more attention to the US indicators. Today we will receive data on expenses and income of individuals for September, forecasts for which are weak: income -0.2%, expenses 0.5% against 0.8% in August. On Monday, the ISM manufacturing PMI for October is expected to decline from 61.1 to 60.4, on Wednesday the volume of industrial orders for September may show a decrease of 0.1%, which will lead to a downward revaluation of GDP, and may also deter the Fed from optimistic forecasts at the meeting on November 3rd.

The situation is completely upward on the H4 chart: the price settled above the signal level of 1.1669, the Marlin Oscillator is growing in the positive area.

Analysis are provided byInstaForex.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks