Oil returned to production

Euphoria over the proximity of the agreement between China and the United States to end the trade war pulled up quotes of the Brent and WTI. Nevertheless, it was worth of Donald Trump to say that the issue of the rollback of import duties has not yet been resolved, China will notice an 11.5% increase in black gold imports in October, and Oman will declare at the OPEC+ meeting that the agreement on production cut would be extended in the previous volume, as the bulls in both varieties began to get nervous.

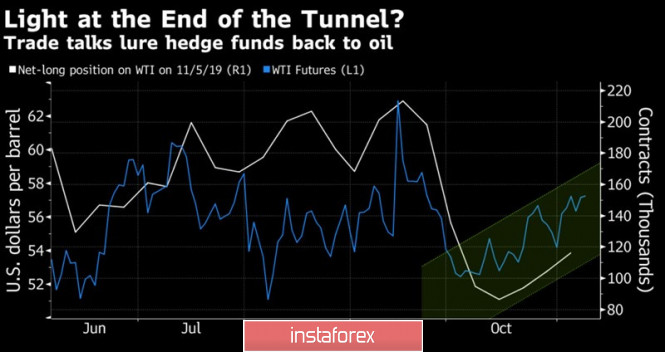

As I noted in several previous materials, the slowdown in shale production in the United States, on the one hand, and the reduction in its volumes by Saudi Arabia, Russia, and other countries, on the other hand, have made the factor in changing global demand as the main driver of pricing. The slowdown in its growth under the influence of trade wars caused oil to fall from April to September, however, as soon as a turning point emerged in relations between Beijing and Washington, the situation changed radically. Speculators began to leave short positions and open long ones, and black gold added about 5% since the beginning of November.

The dynamics of speculative positions and quotes WTI

China is the largest oil consumer in the world, therefore, an increase in its imports in January-October by 10.5% YOY made it possible for investors to raise the logical question: if a trade war does not prevent China from increasing purchases of black gold, is it worth expecting that an agreement between Beijing and Washington will sharply raise prices? It is possible that most of the positive has already been incorporated into the Brent and WTI quotes, so the agreement under Phase 1 will go unnoticed by the players.

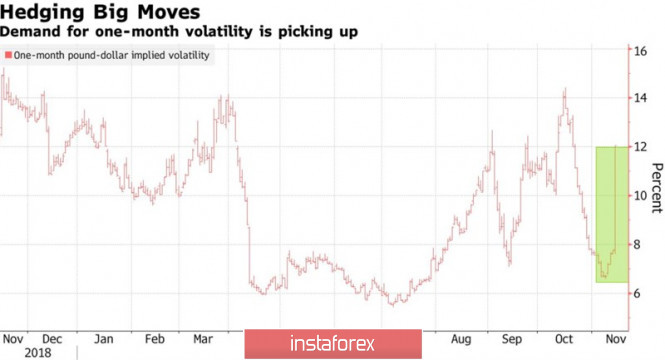

Due to the prevailing principle of "buy by rumors, sell by facts" on the market, oil bulls may have problems after the OPEC+ signs an agreement on the extension of the Vienna agreement. It envisaged a decrease in production by 1.2 million bpd to March 2020. According to representatives of Oman, quotas will remain unchanged. Investors have no doubts about extending the terms of the agreement, so black gold can plunge into a wave of sales. Morgan Stanley believes that with such an outcome of the meeting between the cartel and Russia, prices for the North Sea grade will fall by 30% to $45 per barrel. Citigroup and BNP Paribas are afraid of the decline in Brent and WTI down to their lowest levels since the 1950s.

Only one thing is obvious - the discussions will be hot. Saudi Arabia needs North Sea growth of $84 per barrel and more to finance its wasteful spending, and Iran with its US sanctions - and $195 per barrel altogether. Opponents of further cutting, most likely, will talk about the loss of OPEC+ market share.

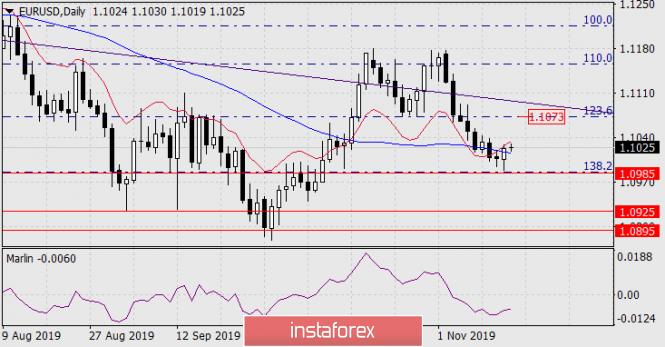

Technically, a breakthrough of resistance at $62.6 and $63.6 (Pivot levels) will make it possible for the Brent bulls to continue the rally in the direction of the targets for the Wolfe Wave and Shark patterns. They are located near the marks of $72.1 and $73.8 per barrel. On the contrary, the inability of buyers to storm important levels will increase the risks of declining quotes to $59.3 and $56.3.

Analysis are provided byInstaForex.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks