Developing USD/CAD pair and trading idea

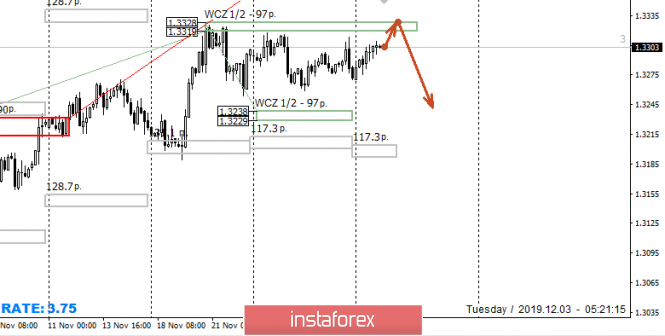

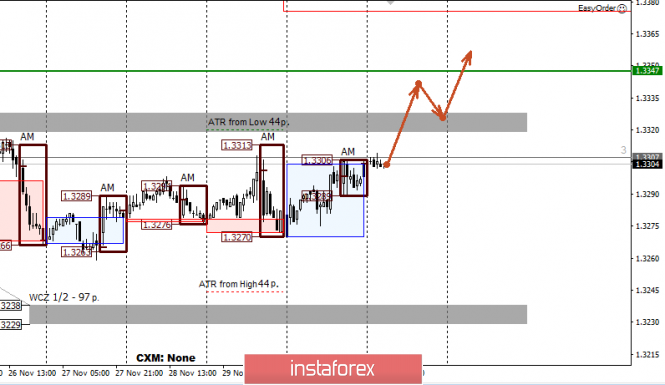

During the previous recommendation on Friday,it is advised to develop the pair at least on a false breakdown of the level of 1.3269. Actually, this is exactly the outcome we are observing - on the news, this level was falsely broken, and thus, the recommendation completely justified itself. The plan was this:

Thus far, the intrigue of the instrument continues. False news breakdown of this level provides a good opportunity for the development of further medium-term upward trend. Since the end of October, there has been a prolonged upward trend on for this instrument, and the probability of its continuation is still high. For this reason, there is another recommendation for the same instrument today. I believe that the development will continue to a minimum to the level of 1.3326. Therefore, you can try to buy with a goal of updating it, limiting the risks at the price of 1.3254, since it makes no sense to keep purchases below the news last Friday. Updating Friday's minimum - the bullish scenario will be completely canceled.

Wishing you all success in trading and huge profits!

Analysis are provided byInstaForex.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks