Forecast for EUR/USD on November 21, 2023

EUR/USD

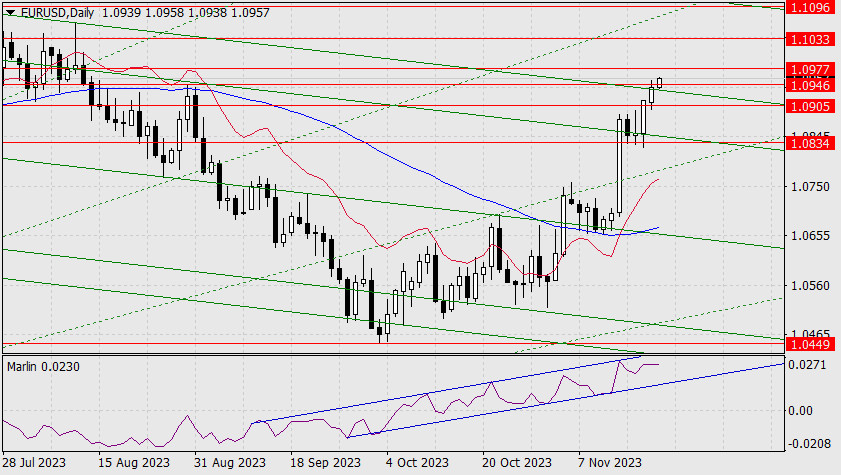

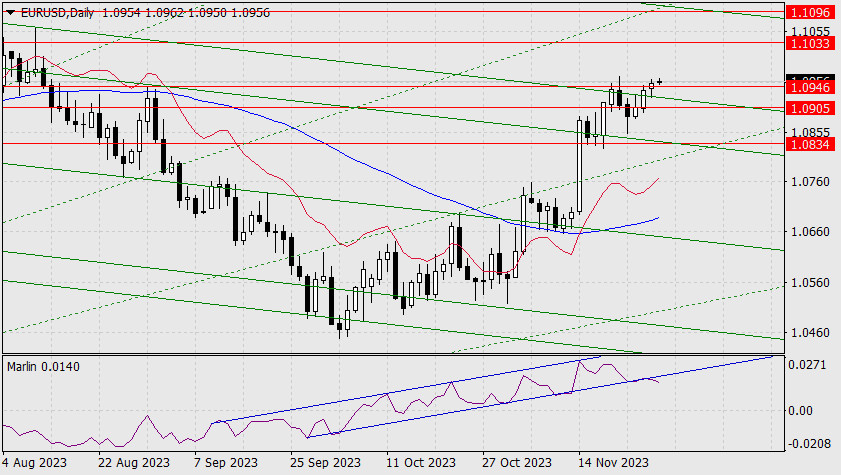

Yesterday, the euro reached the 2-year descending price channel line and the target level of 1.0946. This morning, the price is trying to break above this level towards the nearest target at 1.0977. Once the price surpasses this mark, the next target will be 1.1033 (January peak).

The Marlin oscillator is not in a hurry to rise along with the price, so the risk of a corrective decline increases with each day. Overall, we expect the signal line of the oscillator to be tested at the upper band of the ascending channel.

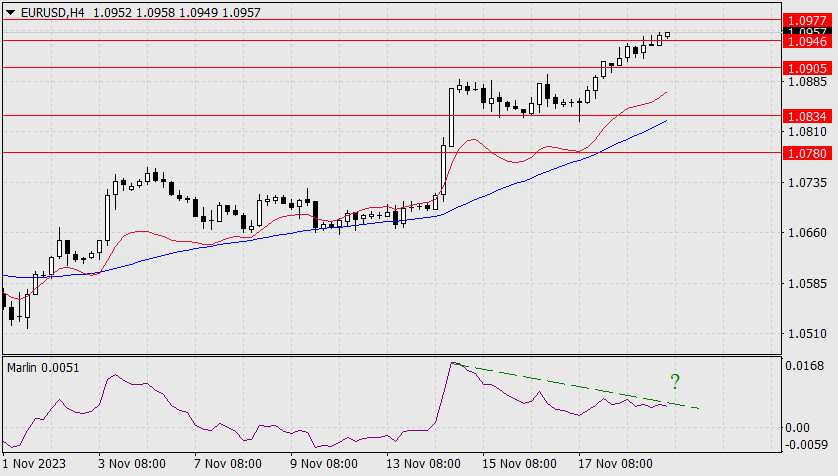

On the 4-hour chart, the price is breaking above the resistance of 1.0946 with a desire to consolidate above it. The Marlin oscillator is turning upward, creating a risk of divergence with the price. However, the reversal is not characteristic of a divergence, so the upward movement has the advantage at the moment.

Analysis are provided by InstaForex.

Read More

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks