Forex Analysis & Reviews: AUDNZD on bearish momentum! | 12 Nov 2021

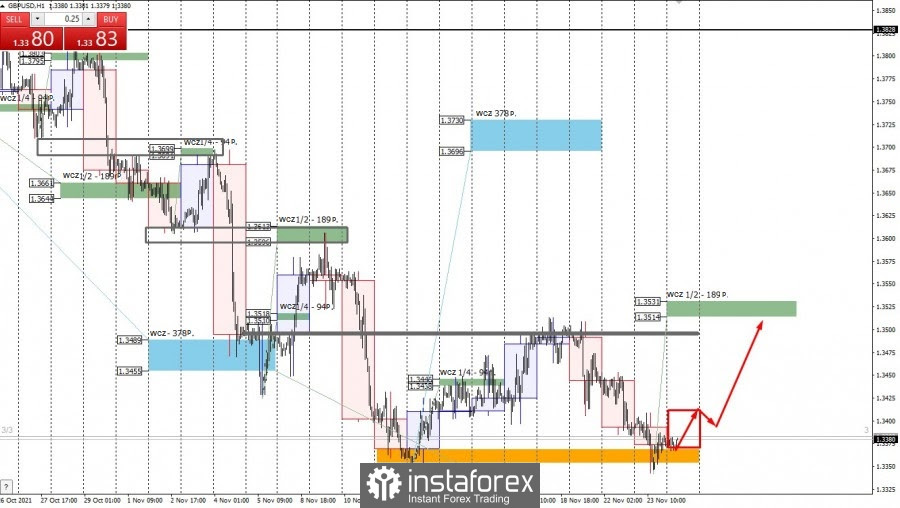

Price is on a bearish momentum and abiding to our bearish trendline. We see potential for a bounce from our 1st resistance at 1.04277 in line with 50% Fibonacci retracement and 38.2% Fibonacci retracement and graphical overlap towards our 1st support at 1.03297 in line with 100% Fibonacci extension. Alternatively, our stop loss will be placed at 2nd resistance at 1.04617 in line with 50% Fibonacci retracement and graphical overlap. RSI is approaching levels where dips occurred previously and ichimoku is showing bearish momentum.

Trading Recommendation

Entry: 1.04277

Reason for Entry:

50% Fibonacci retracement and 38.2% Fibonacci retracement and graphical overlap.

Take Profit: 1.03297

Reason for Take Profit:

100% Fibonacci extension.

Stop Loss: 1.04617

Reason for Stop Loss:

50% Fibonacci retracement and graphical overlap.

Analysis are provided byInstaForex.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks