The dollar turned into a Whipping Boy

These factors try to justify the current weakening of the dollar. However, the hurricanes did not affect anything important either in the financial world or in oil and gas production. Even the nuclear missiles, that cannot fly as far as the US, have little effect.

Over the past week, the dollar has weakened considerably. Both the euro and the pound have been strengthening day by day. In many ways this was contrary to common sense, or at least it seemed so at first glance. It is often said that the blame for all the hurricanes that hit the south of the United States is the nuclear tests of the DPRK.

The television footage of the destruction caused by the hurricane in Texas, of course, is impressive. Especially when you realize that we are talking about the second-largest economy and the second-largest population in the state. The first thought that this footage led to is panic, which inevitably affected the dollar. Moreover, if you remember, Texas is famous for its oil workers. It's as if the hurricane caused huge damage to France. However, Texas is a huge state, bigger than most countries in the world. The hurricane affected only a small part of it, and oil production in the United States has long ago moved north of Texas itself. Shale oil and gas in the state is not affected too much. Also, do not forget that in terms of the financial world, Texas is simply insignificant. Another thing, it is in New York or Chicago where large investors and financial tycoons live. Well, it was the case back in Boston. In short, it's not worth writing off everything for a hurricane.

North Korea have caused a lot of people to worry about ballistic missile launches. Here, the weakening of the dollar is explained by the fear of investors of the nuclear strikes of Kim Jong-un. However, everything here is very strange. After all, North Korea has never launched a missile capable of flying to the US territory. Experts only suggest that they have them. But here's what the DPRK definitely has: missiles that are capable of hitting the territory of Japan. About South Korea, they said nothing. So, if all these investors are so afraid of a nuclear attack from the DPRK, it is more logical to transfer money to where they will be the least probability of being hit. Namely, in the US and Europe. Despite this, the dollar weakened against all currencies.

There was also the speech by Mario Draghi which was held immediately after the ECB meeting on monetary policy. He said that if necessary, the program of quantitative easing will be extended beyond December of this year. He also added that interest rates will remain low for a long time. After such words, any currency would inevitably collapse. However, a lot rests on the fact that Mario Draghi did not express concern about the euro. It is understandable that he did not speak about it, since the euro is not a priority for the ECB. The European Central Bank has more important tasks.

So it is necessary to state a simple and banal thing: investors are fleeing from the dollar.

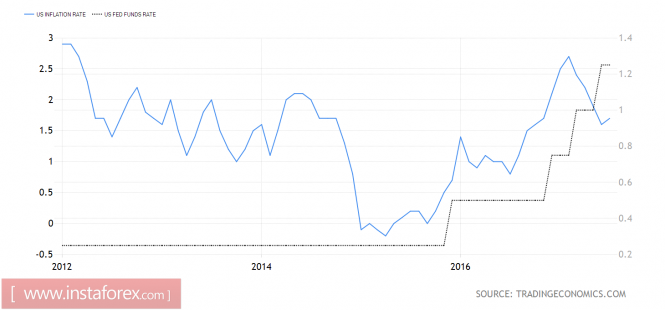

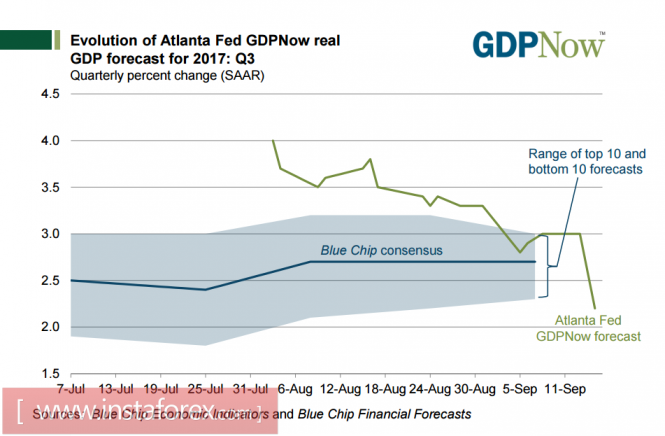

The reason is that investors do not care whether things are going badly or well. It is important for them that the situation is understandable and predictable. Here, in Europe, everything is clear. For a long time, the ECB and the Bank of England will pursue an ultra-soft monetary policy. This, of course, is not very good, but at least it's predictable. In the United States, it is not at all smooth. In the first half of the year, it was promised that by the end of the year, the Fed will refinance the rate of 1.5%. This strengthened the dollar. Now, there are a lot of questions to the Fed, including the rate, which, perhaps, will be left at the level of 1.25%. And since the rate will not be raised any more, then there is nothing anymore to lie about without money.

This scenario will please the eyes of market participants this week. Now, a new hurricane will hit Florida, which is the third largest population and the fourth largest economy by the state. However, the value of Florida is much smaller than that of Texas, so it is quite difficult to use it as an excuse to justify the weakening of the dollar. Especially, since in Florida, unlike Texas, there is no serious industry. The state's position on the size of the economy is only because of the size of the population. However, there is no doubt hurricanes will be used as an excuse.

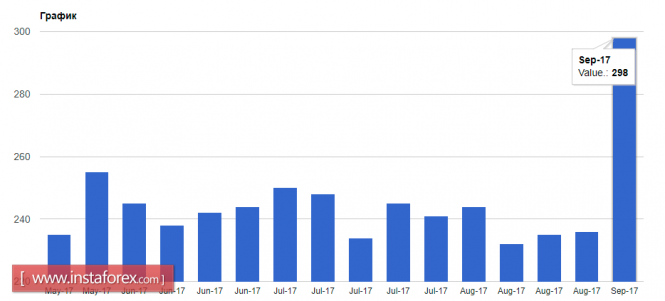

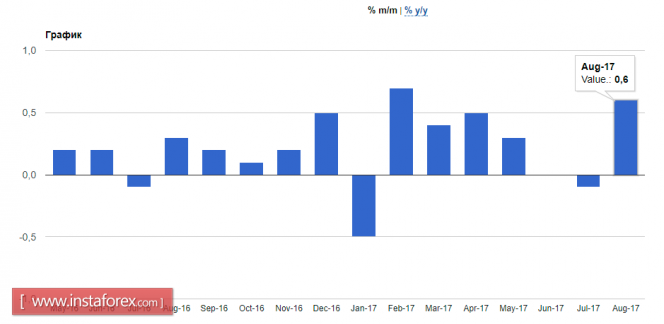

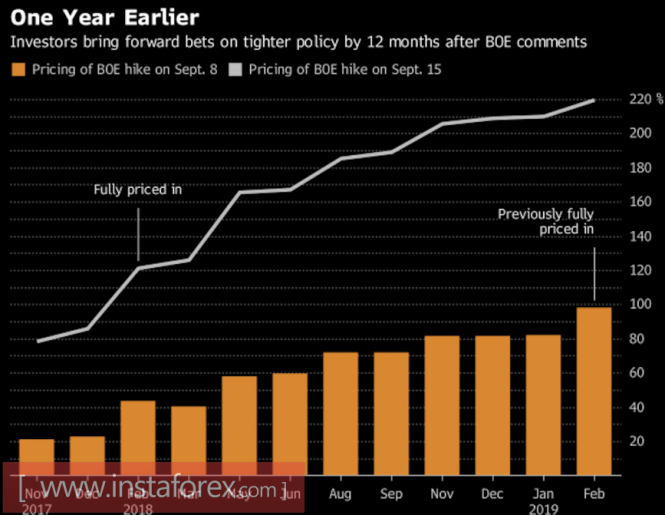

Another argument in favor of the weakening the dollar is the upcoming meeting of the Bank of England on monetary policy. First, there will be data on inflation, which should show acceleration from 2.6% to 2.8%. If these forecasts are justified, then the number of supporters of the increase in the refinancing rate in the Bank of England will increase. Since the hopes for a rapid increase in the rate in the United States have not been justified, it is worth seeing the UK try. So, the dollar still has to fall in price. Moreover, in the US, a significant slowdown in the growth rate of retail sales is expected from 4.2% to 3.1%.

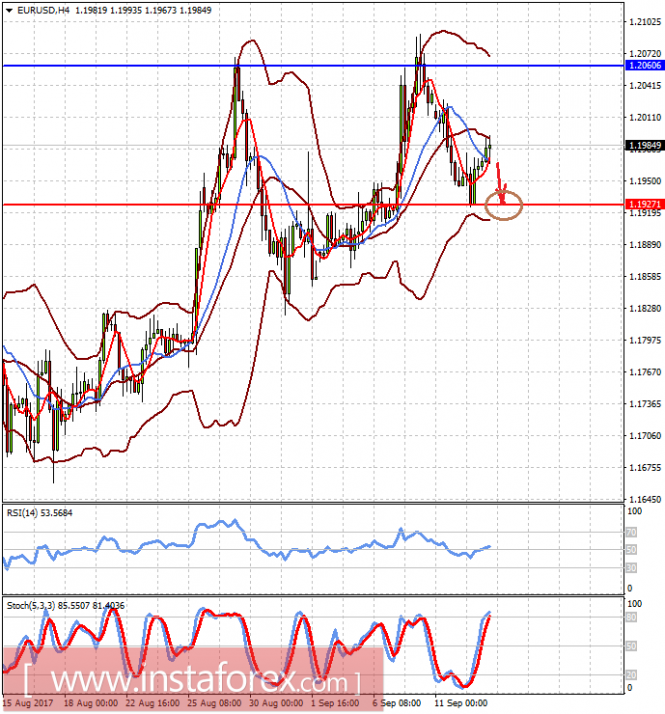

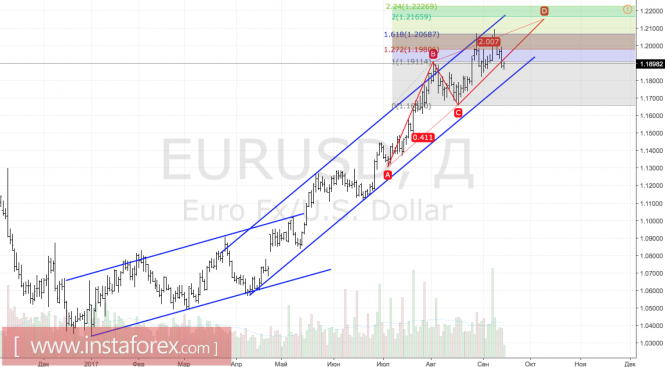

Considering that practically no significant news is coming out in Europe, the EUR/USD pair, if it grows up, is insignificant. Hysteria about the hurricane in Florida will not allow the dollar to strengthen, so there is a high probability of consolidation around 1.2000.

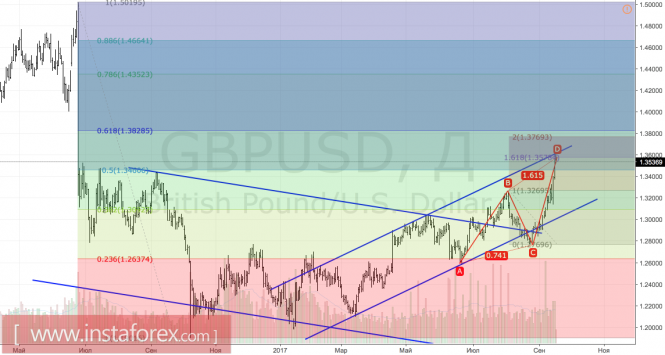

If the number of votes for raising the refinancing rate in the Bank of England is three or more, then the GBP/USD pair will rise to 1.3350. If inflation increases, the members of the Bank of England board will be cautious, and a pound drop to 1.2950 is possible.

Analysis are provided byInstaForex.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks