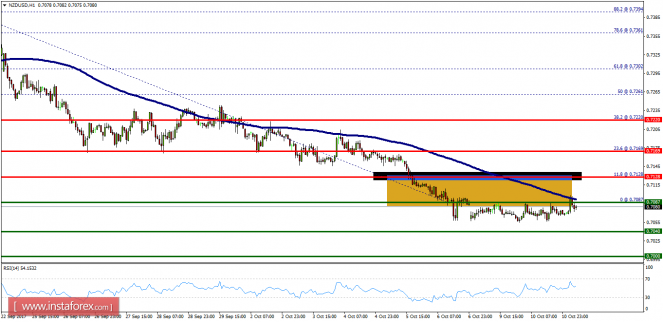

Technical analysis of NZD/USD for October 11, 2017

Overview:

The NZD/USD didn't make significant movement yesterday. There are no changes in my technical outlook. The bias remains bearish in the nearest term testing 0.7000 or higher. Immediate support is seen around 0.7087. The NZD/USD pair fell from the level of 0.7128 towards 0.7087. Now, the price is set at 0.7069 to act as a minor support. It should be noted that volatility is very high for that the NZD/USD pair is still moving between 0.7128 and 0.7040 in coming hours. Furthermore, the price has been set below the strong resistance at the levels of 0.7169 and 0.7220, which coincides with the 23.6% and 38.2% Fibonacci retracement level respectively. Additionally, the price is in a bearish channel now. Amid the previous events, the pair is still in a downtrend. From this point, the NZD/USD pair is continuing in a bearish trend from the new resistance of 0.7128. Thereupon, the price spot of 0.7128/0.7087 remains a significant resistance zone. Therefore, a possibility that the NZD/USD pair will have downside momentum is rather convincing and the structure of a fall does not look corrective. In order to indicate a bearish opportunity below 1.0020, sell below 0.7128 or 0.7087 with the first targets at 0.7040 and 0.7000 (support 3). However, the stop loss should be located above the level of 0.7169.

Analysis are provided byInstaForex.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks