Forex Analysis & Reviews: EUR/USD Forecast for September 5, 2025

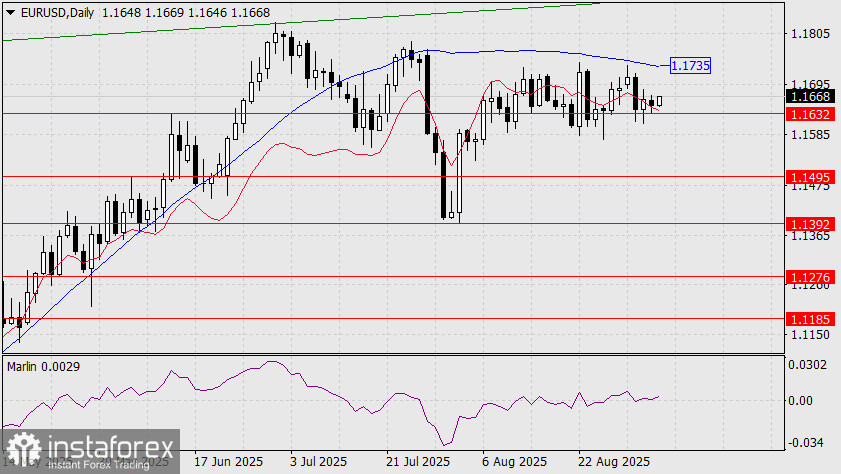

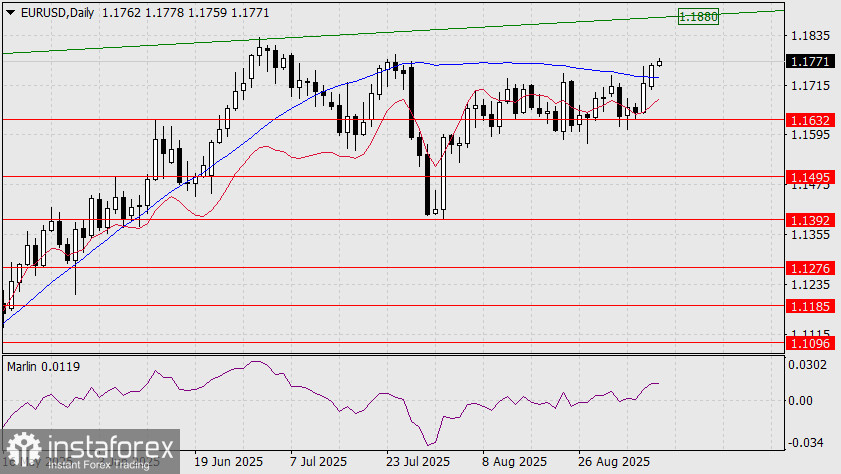

EUR/USD The euro has not yet managed to break (even on a daily close) below the support level at 1.1632 ahead of today's US employment data. The Marlin oscillator has spent the last three days right at the border between trends, clearly signaling neutrality.

Yesterday's ADP private sector employment data showed an increase of 54K jobs, against a forecast of 73K. The numbers don't diverge much. Similarly, today for Nonfarm Payrolls, we expect data to be around the estimates of 75K. Is this a good result? Yes, it's a good figure—especially considering that since the start of the year (or since Q4 of last year), "competent authorities" say there have been month-to-month upward revisions of about 60K per month for nonfarms. We believe that major players have already digested the whole labor market picture, now viewing it as not weak, but weakening. If we assume market participants refrain from speculative action, the single currency could continue sideways until the Fed meeting. On the other hand, the euro's gains over the past 6-8 months have largely priced in a double Fed rate cut—and even a nonfarm result just a bit above forecast could put pressure on the euro. This has been our main scenario for months. So, the euro's first target is 1.1495—the June 5th high.

On the four-hour chart, price has reached the MACD line and the balance line; the Marlin oscillator's signal line has reached the zero line. The situation is "completely neutral"—in any case, it's uninformative and calls for just one thing: wait for the news. The range between 1.1632 and 1.1670 appears to be an ideal area for waiting for those releases.

Analysis are provided by InstaForex.

Read more: https://ifxpr.com/465CrwR[/youtube]

5Likes

5Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks