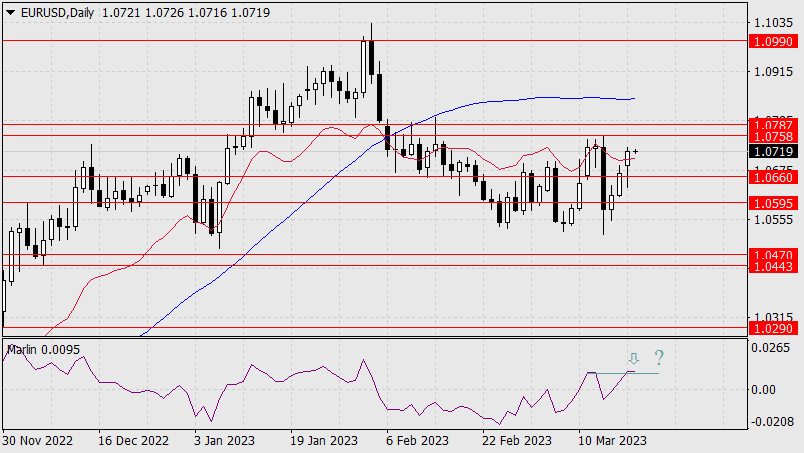

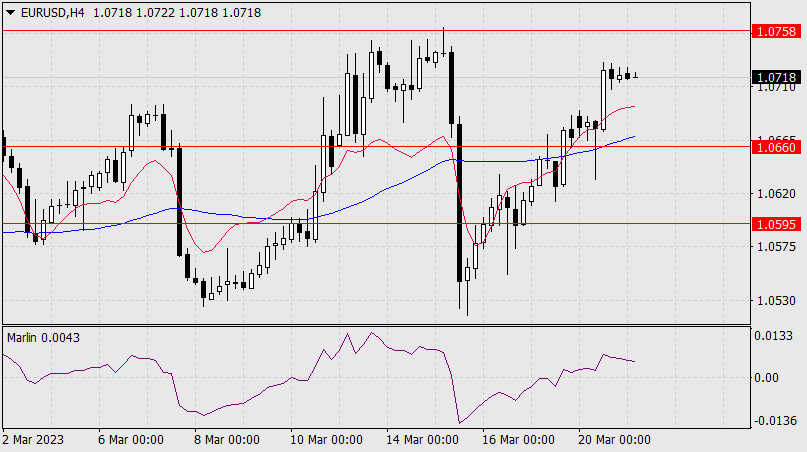

ELLIOTT WAVE ANALYSIS OF EUR/USD FOR MARCH 15, 2023

EUR/USD has consolidated just above the double bottom neckline near 1.0710 and is ready to push higher towards the next minor resistance at 1.0807. EUR/USD is making its way higher to the 1.1248 target and possibly even closer to 1.1424 before wave 5 is in place.

Support is seen at 1.0710 and then at 1.0636 which we expect will be able to act as a floor for the next impulsive rally higher towards 1.1248 and possibly higher.

Analysis are provided by InstaForex.

Read More

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks