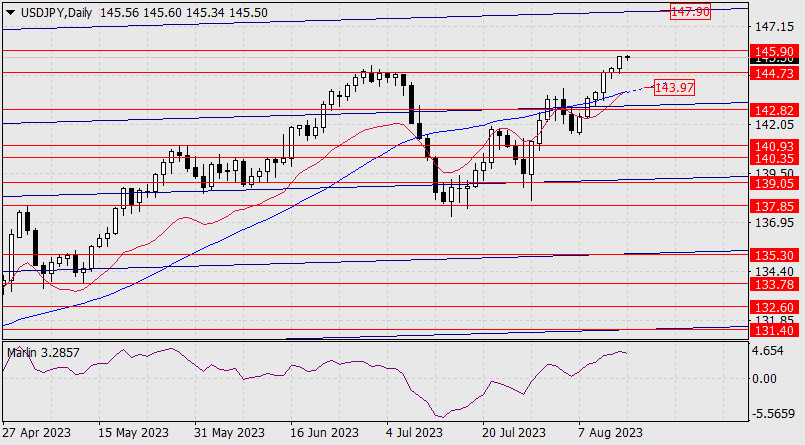

Forecast of USD/JPY on August 15, 2023

USD/JPY The USD/JPY pair is approaching the target level of 145.90. The Marlin oscillator is gradually turning downwards on the daily chart, indicating a correction towards the nearest support level at 144.73. If the pair surpasses this mark, the next corrective target would be the MACD line at 143.97.

If the price consolidates above 145.90, the pair might continue to rise to the nearest resistance of the global hyperchannel around the 147.90 mark. Beyond this level lies the 148.50 target. The bulls will probably aim for the 147.90-148.50 range next.

The shorter timeframe shows us that the MACD line is approaching the support line of 144.73. This fact certainly supports the uptrend, reducing the risk of a deep correction. However, the Marlin oscillator, being a leading indicator, is not growing but gradually decreasing. We expect traders to struggle at the 144.73 level.

Analysis are provided by InstaForex.

Read More

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks