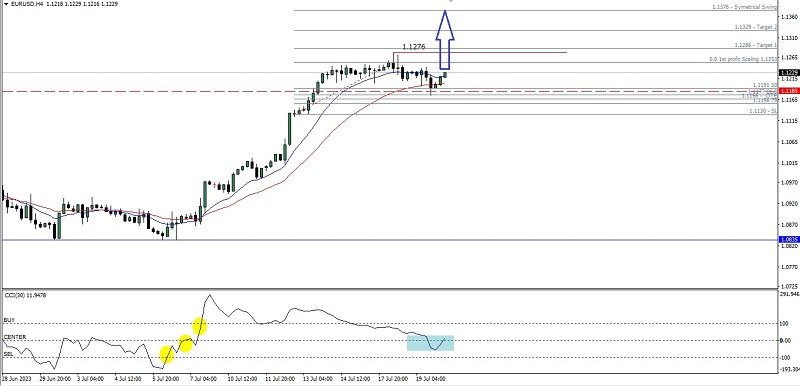

Forecast for EUR/USD on July 19, 2023

EUR/USD

Yesterday's US economic data did not push the dollar higher. Retail sales for June showed a 0.2% increase, while industrial production declined by 0.5%. The dollar was also hindered by surveys conducted among 109 economists, the majority of whom considered the July rate hike by the Federal Reserve as the last in the tightening cycle.

Today, the EU will release its inflation data, with a forecast of 5.5% YoY compared to 6.1% YoY in May. Good data may have an impact on European monetary policymakers. However, on the daily chart, the euro is consolidating below the resistance level of 1.1237, which, together with yesterday's attempt at growth, keeps the bulls' interest towards aiming for the 1.1320 level. The Marlin oscillator is steadily falling, which supports the notion of a downward movement.

On the four-hour chart, the price is currently between the signal level of 1.1205 and the resistance level of 1.1237. Breaking through the signal level will allow the price to fall towards the target support level of 1.1155. The Marlin oscillator has moved into a downtrend territory, indicating the potential for short-term downward movement. The delay in the euro's fall has led to the MACD indicator line surpassing the target range of 1.1076/96 and heading towards 1.1155. This means that the focus is shifting from the support range to a higher level, from which it may reverse to the upside. Therefore, 1.1155 serves as a reference for the corrective decline.

Analysis are provided by InstaForex.

Read More

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks