Forecast for GBP/USD on June 21, 2023

GBP/USD

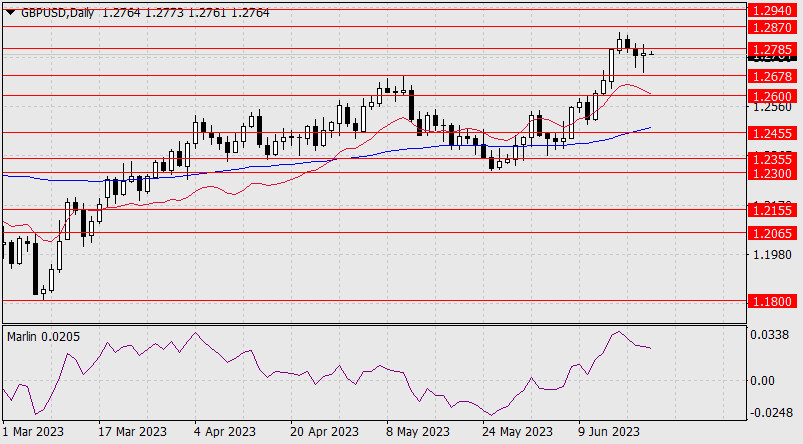

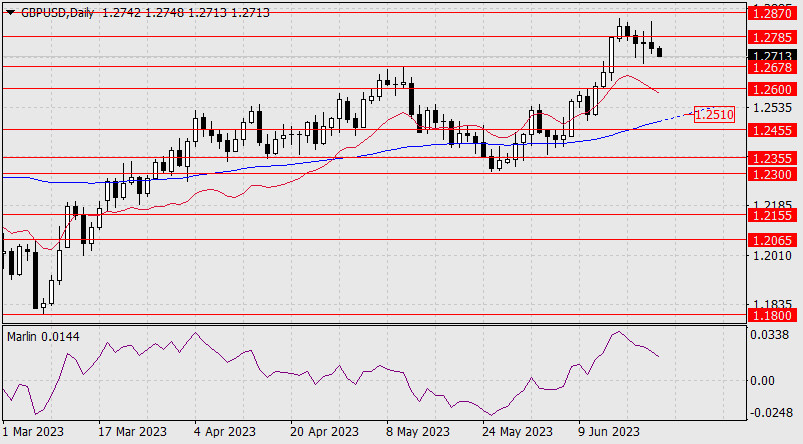

Yesterday, the British pound settled below the linear resistance at 1.2785. The Marlin oscillator's signal line is declining, inspiring the British pound not to hesitate in reaching the target support level at 1.2678. However, the price needs a good reason - a slowdown in the inflation report from the National Statistics Office. The forecast for the CPI is expected to be 8.5% YoY, compared to April's 8.7% YoY. If the data shows that inflation is getting stronger, the price may try to reach the target level of 1.2870.

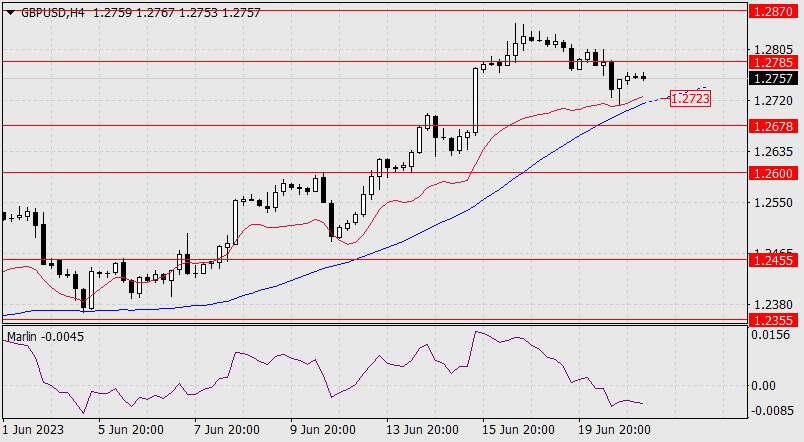

On the 4-hour chart, the price found support from the balance line (red indicator). This hints at investors' desire to maintain an upward situation, as the Bank of England is expected to raise the interest rate by 0.25% tomorrow, with its planned four more rate hikes by the end of the year, totaling 5.75%. This would align with the Federal Reserve's interest rate by the end of the year (assuming two rate hikes by the Fed by year-end).

From a technical perspective, the price should settle below the MACD line, below 1.2723, if it intends to make at least a false downward movement. For a more confident decline, the price should establish itself below 1.2678.

Analysis are provided by InstaForex.

Read More

5Likes

5Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks