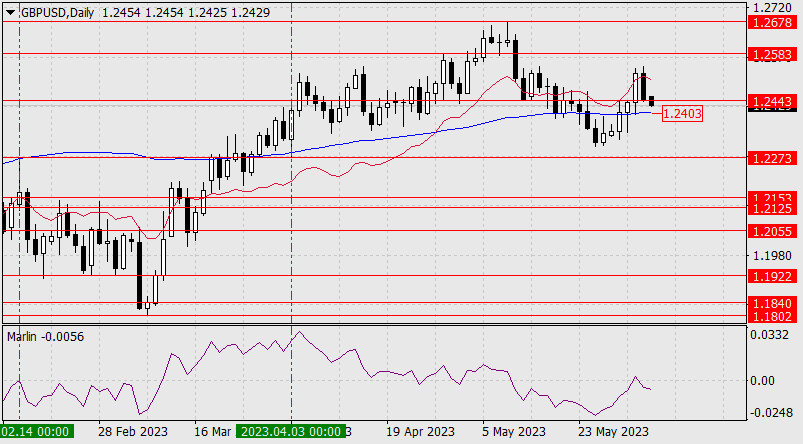

Forex Analysis & Reviews: Forecast for EUR/USD on May 24, 2023

EUR/USD:

The euro is falling for significant reasons - the imminent increase in the debt limit (which will lead to a massive influx of dollars from outside to purchase US government bonds) and a more hawkish stance from the Federal Reserve regarding interest rates than what the markets currently expect (yesterday, Neel Kashkari and James Bullard mentioned raising rates above 6% as inflation persists).

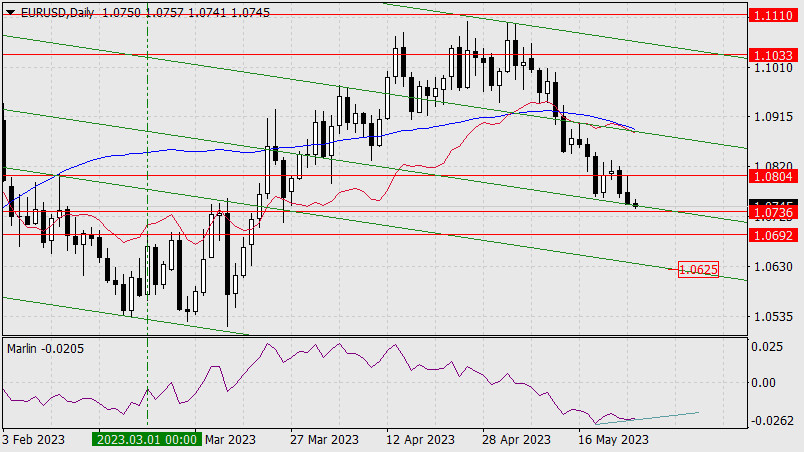

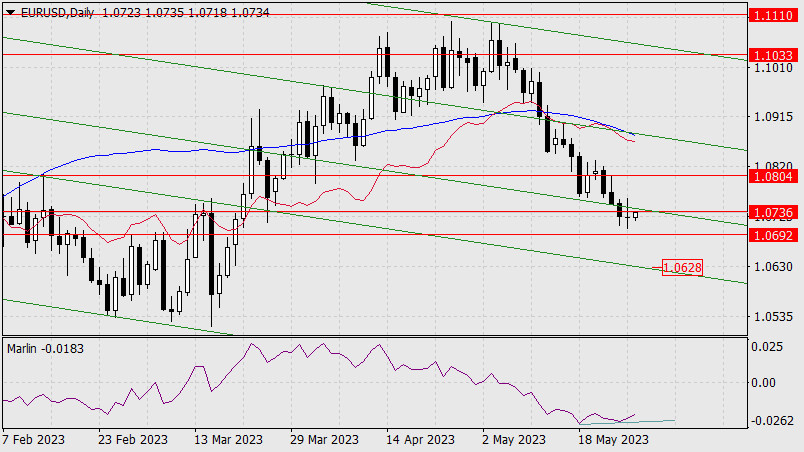

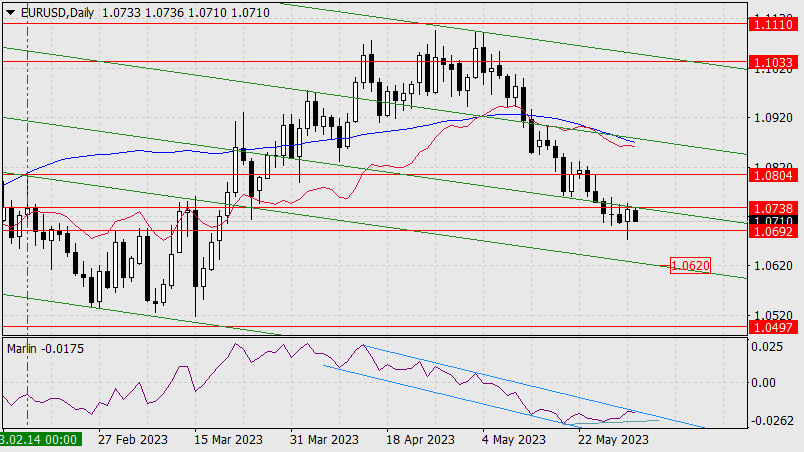

However, from a technical standpoint, the situation is ripe for a correction. On the daily chart, a small weak convergence between price and the Marlin oscillator is forming. The price has not reached the embedded line of the price channel (green line), creating a dual situation: either the inclined support will be tested today, or the price will go up to 1.0804 and only after that will it attack 1.0736, surpassing the price channel line. A drop below 1.0736 opens the target at 1.0625, the lower embedded line of the price channel.

On the 4-hour chart, the price is falling below both indicator lines, and the Marlin oscillator is declining in bearish territory. The resistance level at 1.0804 is reinforced by the MACD indicator line here. Yesterday's trading volumes were at average May levels, which does not provide a basis for an immediate breakthrough of support. Perhaps a small correction will allow investors to accumulate short positions.

Analysis are provided by InstaForex.

Read More

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks