Washington and Beijing loosened the nuts. A thin world or calm before a storm?

The unexpected decision of the US administration to delay the introduction of 10% tariffs on a number of goods imported into the United States from China revived the markets. Investors began to buy cheaper assets.

Why did the White House retreat? Maybe the United States really wants to make concessions, or did they just see that Beijing was not afraid of their tariffs? It is enough to recall how China devalued the yuan quite simply in order to smooth out the negative effect of the duties introduced by the US.

It is noteworthy that today the People's Bank of China raised the yuan to the dollar for the first time in two weeks - up to 7.0312. Previously, the regulator continuously depreciated the national currency, as a result of which it updated lows since the spring of 2008.

Judging by the comments of Donald Trump, the US president's decision to postpone the introduction of new Chinese tariffs for a number of positions until December 15 is not a sign of progress in the Washington-Beijing trade negotiations, but rather a result of pressure from US companies.

"We are doing this taking into account the upcoming Christmas holidays so that some of the duties do not hit consumers in the United States," he said.

Thus, the head of the White House for the first time admitted that tariffs could harm the US economy.

Goldman Sachs believes that Washington's departure from its original plan to levy duties on all Chinese exports to the United States is a reaction to the fall of US stock indices.

According to Moody's, the recent events should not be seen as a de-escalation of the conflict between the United States and China: this is just a temporary delay.

"D. Trump is afraid to look weak and unable to achieve the goal. In addition, he fears that his chosen strategy of a trade war with China will be ineffective both in the eyes of his own voters and China itself," reports the Chinese publication Global Times.

"The US is making concessions as soon as negotiations between the two countries are on the verge of a complete break. Washington's latest softening said it recognizes that pressure tactics on Beijing aren't working," said Bai Ming, an analyst at the Chinese Academy of International Trade and Economic Cooperation.

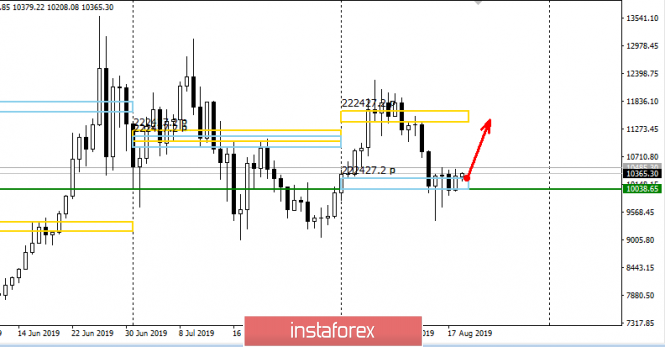

However, regardless of the White House's motives, the latest news from the trade front caused a stormy positive reaction from the markets, allowing US indices to win back the decline of the beginning of the week, and the greenback appreciably strengthened against major currencies, especially against the yen. The USD/JPY pair has broken the 106 mark.

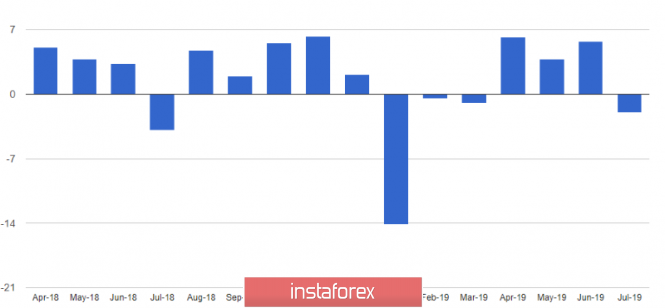

Data that was published yesterday also provided some support for the US currency, since the release showed the best (since 2006) two-month increase in core inflation in the United States. In July, the indicator increased by 0.3% in monthly terms and by 2.2% in annual terms. The fact that inflation accelerates after a sluggish start reduces the risks of aggressive easing of the monetary reserve monetary policy. The chances of a September cut in the federal funds rate by 50 basis points at once fell from 25% to less than 10%. The Fed leadership is becoming less likely to further lower interest rates.

Today, the yen against the dollar has returned to growth amid continued geopolitical risks.

Despite recent U.S. moves, markets are not waiting for a quick resolution to Washington and Beijing trade disputes, which put pressure on the entire global economy.

Analysts also note the presence of geopolitical tensions in different regions of the world, which supports the demand for the yen.

"Recent news provides more opportunities to strengthen the dollar and weaken the yen, but this does not mean that trade differences are resolved. In addition, there are many geopolitical risks, such as the situation in Hong Kong, the upcoming Brexit and the situation around Iran. Therefore, I do not expect significant demand for risky assets," said Tohru Sasaki, an analyst at JPMorgan Chase Bank.

It is assumed that if China feels D. Trump's weakness and begins to dictate its conditions, then we will again see the corresponding market reaction, the opposite of the one observed yesterday.

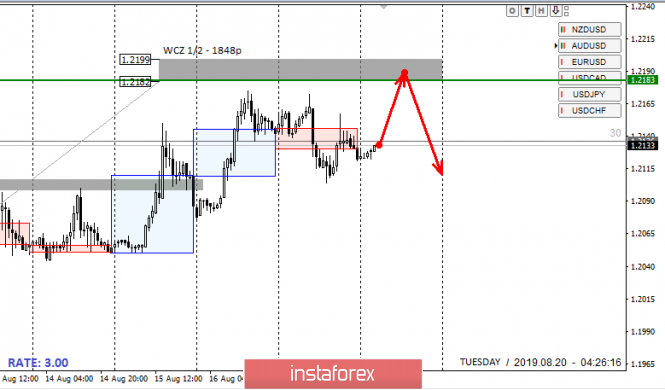

As for the main currency pair, it still remains within the wide lateral range.

The gloomy results of recent studies of business sentiment in Germany today have been confirmed by actual economic indicators. According to Destatis, German GDP declined 0.1% in the second quarter compared to the first quarter.

According to analysts, two negative quarterly indicators in a row will indicate a technical recession in the country, which is the locomotive of the entire European economy. However, the eurozone as a whole remains in relative safety: its GDP continued to grow in the second quarter, although only by 0.2% in quarterly terms.

Analysis are provided byInstaForex.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks