Oil flies into the stratosphere

Attacks on tankers in the Persian Gulf and a downed American drone are children's toys compared to the attack on Abqaiq, the world's largest oil refinery in Saudi Arabia, through which about 7 million b/d passes. Brent and WTI have responded with the largest daily rally in history, and it cannot be said that investors have calmed down. The attack can easily be repeated, the US war with Iran is more real than ever, and who, interestingly, in such circumstances will risk actively selling black gold?

An armed attack turned off 5.7 million bpd from the game, which is about 5% of global production. Although Riyadh is trying in every possible way to convince investors that everything is under control and within a day, about a third of the losses in black gold production have already been restored, insider Bloomberg says something else. According to at least four competent sources, the restoration is likely to drag on from a few weeks to several months, and a reduction in global production will provide all possible assistance to the Brent and WTI bulls. Everyone is waiting for comments from Prince Abdulaziz bin Salman, but the very figure of this man deserves close attention.

After a member of the royal family became the Minister of Energy for the first time in history, many suspected that something was wrong. Prices rose by leaps and bounds, and the attack on Abqaiq is perceived as a bolt from the blue, but only by a majority. When a crime occurs, one always wonders, "who benefits?" For a balanced budget, Saudi Arabia needed oil at $80 per barrel, but before the appointment of Abdulaziz bin Salman as minister, there were few reasons for a rapid rally. Reducing OPEC production did not help: the Americans were actively increasing production, and China was cutting demand. For a sharp rise in prices, force majeure was needed, and in an amazing way it became a reality.

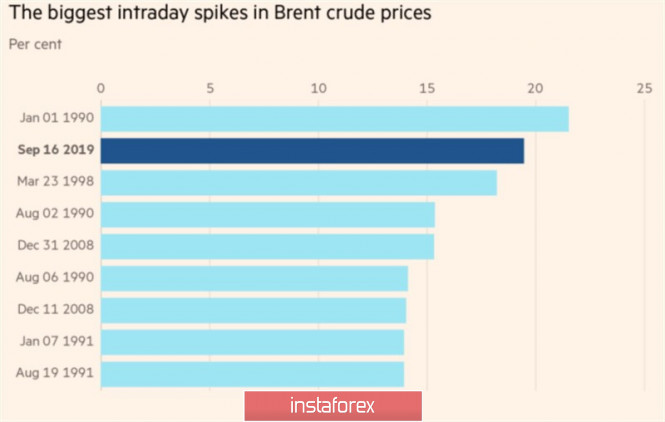

One-day oil jumps

According to Bloomberg, the maximum reserve capacity that can be put into production in the coming weeks is 3.9 million bpd. Even if Riyadh recovers a third of the losses from 5.7 million bpd, there will be a reduction in production. And with it, the growth of Brent and WTI quotes. As for Saudi Arabia, it is in its interest to spread rumors about a slow return to previous levels and the disruption of the October supplies, as well as to call other OPEC members to implement Vienna agreements, which the Saudis do.

At the same time, the issue of the United States and Iran's trade war, which the United States accused of organizing the attack on Abqaiq, does not come up on the agenda. Tehran denies any involvement, and based on the principle "who needed it most", it is very likely that it really has nothing to do with it.

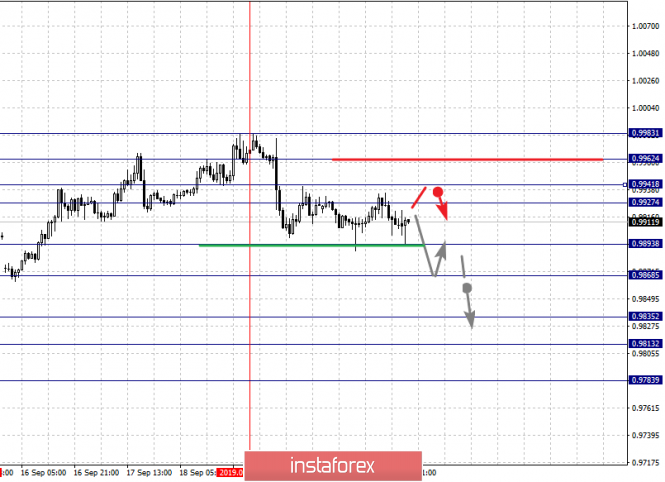

Technically, after completing the targeting on the Bat (113%) and Wolfe Waves patterns, the risks of a pullback increased to the levels of 23.6% and 38.2% of wave 4-5. End of support at $66.4 and $64.4 per barrel will attract new buyers to the market.

Analysis are provided byInstaForex.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks