Forecast for GBP/USD on September 1, 2023

GBP/USD

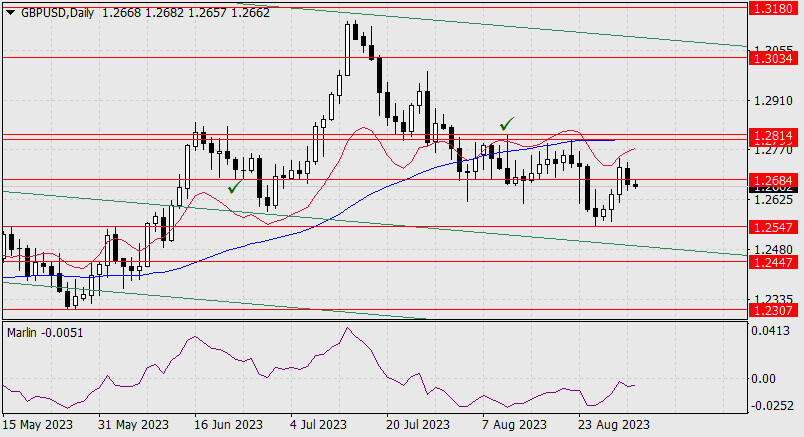

As a result of yesterday, the pound fell by 46 points, returning below the 1.2684 level. The signal line of the Marlin oscillator on the daily chart isn't in a hurry to move downwards; on the contrary, it indicates an intent to rise above the zero line.

If the pound realizes this intention, then the pair could rise in the target range of 1.2799-1.2814. Traders across markets are eagerly awaiting today's US employment data for August. If they turn out to be strong, the pound might head towards 1.2547.

On the four-hour chart, the price consolidated below the MACD indicator line, with the Marlin oscillator in a waiting position in the uptrend territory. While waiting for the US data, the price might rise above 1.2684, which would significantly improve the bulls' positions.

Analysis are provided by InstaForex.

Read More

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks