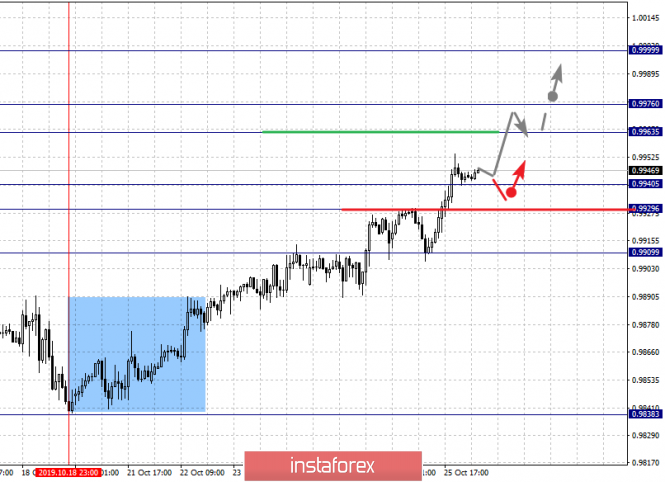

EUR/USD - through thorns to the stars!

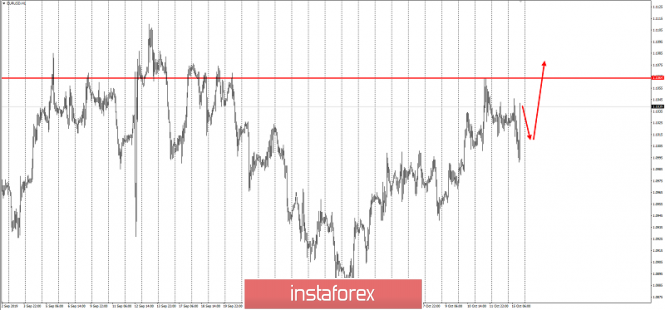

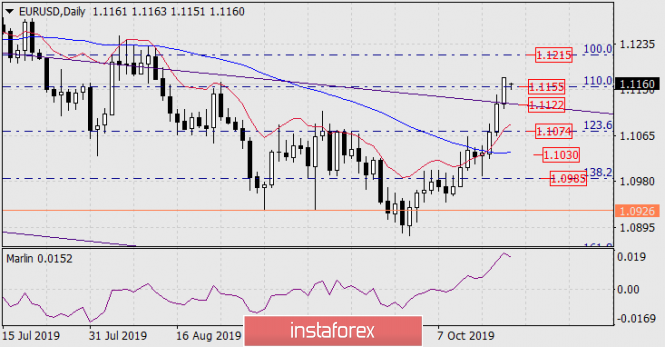

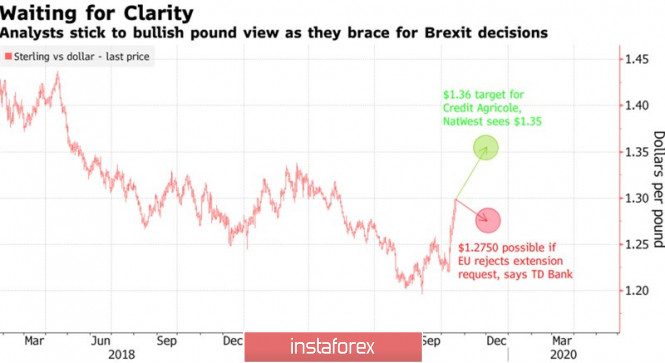

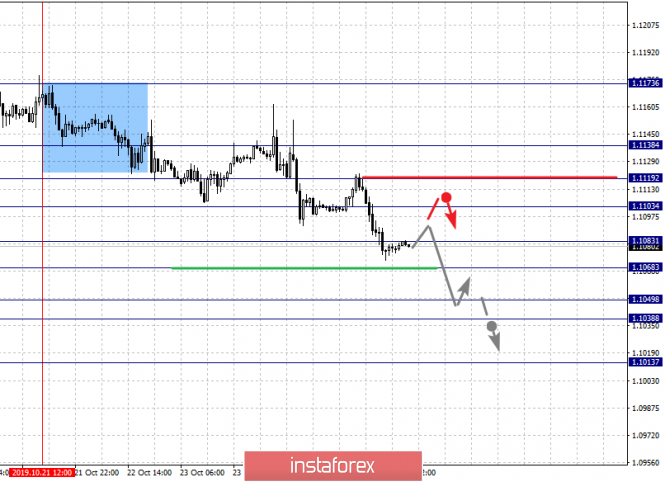

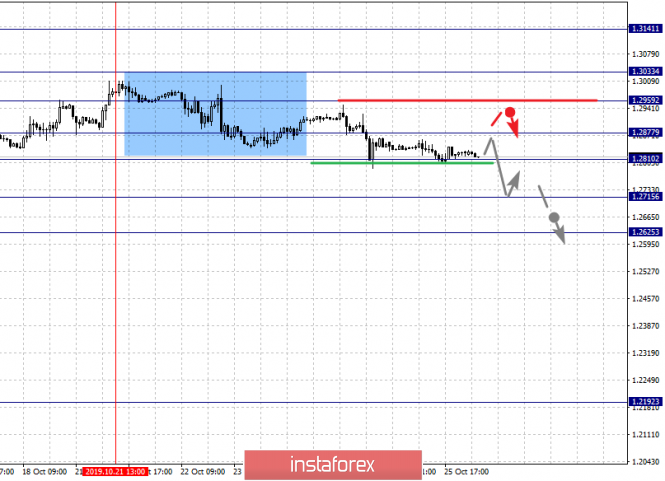

Greetings, dear traders. It is time to remember about EUR/USD, which has successfully fulfilled our previous plans. Following GBP/USD, the European currency is now demonstrating a strong bullish direction. It's easy to guess that all these movements are connected with the next portion of news regarding Brexit. If you omit all the fundamental details and focus on how to make money from it, the answer is simple. To take a neat positions in the purchases with a pullback. At the same time, wherever you try to buy, the extreme point of the scenario cancellation is today's minimum at the quote of 1.0991. Therefore, you can limit losses to this level. It is recommended to holding purchases (at least partially) at the level of 1.1064, since this is an important level for sellers over the past few days.

I wish you success in trading and big profits!

Analysis are provided byInstaForex.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks