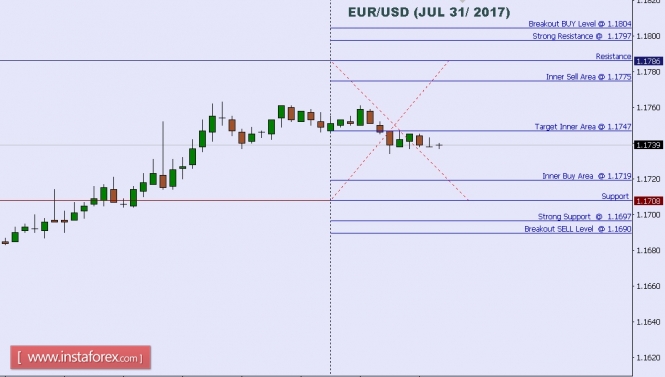

Technical analysis of EUR/USD for July 27, 2017

When the European market opens, some Economic Data will be released, such as Private Loans y/y, M3 Money Supply y/y, GfK German Consumer Climate, and Spanish Unemployment Rate. The US will release the Economic Data, too, such as Natural Gas Storage, Prelim Wholesale Inventories m/m, Goods Trade Balance, Durable Goods Orders m/m, Unemployment Claims, and Core Durable Goods Orders m/m, so, amid the reports, EUR/USD will move in a low to medium volatility during this day.

TODAY'S TECHNICAL LEVEL:

Breakout BUY Level: 1.1787.

Strong Resistance:1.1780.

Original Resistance: 1.1769.

Inner Sell Area: 1.1758.

Target Inner Area: 1.1730.

Inner Buy Area: 1.1702.

Original Support: 1.1691.

Strong Support: 1.1680. Breakout SELL Level: 1.1673.

Analysis are provided byInstaForex.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks