Yellen's words will be fatal for the dollar

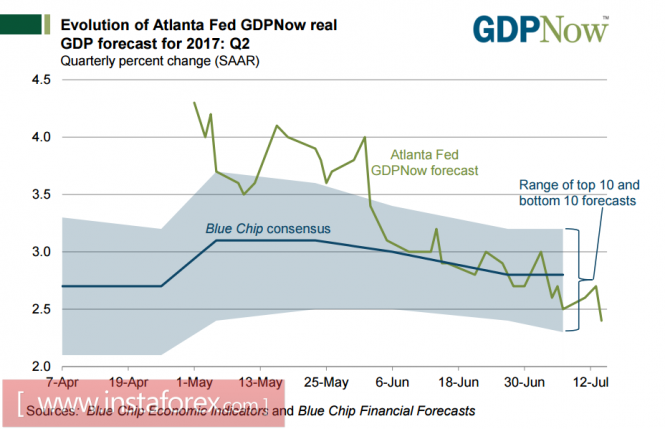

Speeches by members of the Federal Reserve, Brainard and Kashkari, caused the US dollar to collapse on Tuesday. Their words raised fears that the Fed will not risk raising rates anymore for this year and perhaps in the next year too.

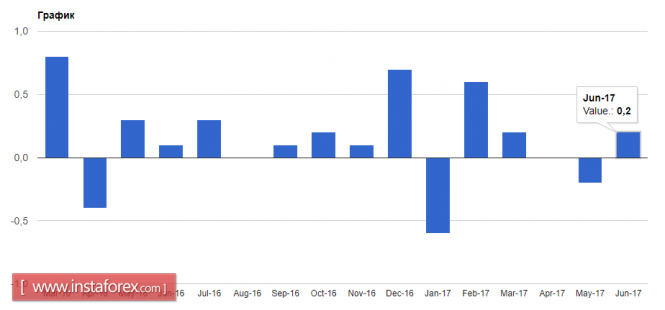

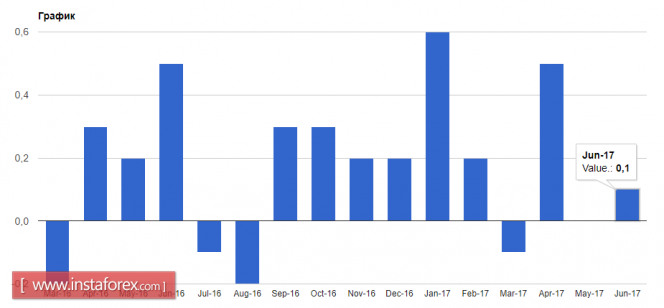

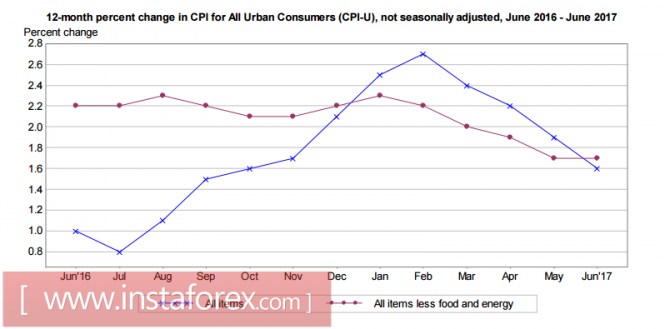

In the address of Fed representative, Lael Brainard, she expressed doubts that the next increase in interest rates would occur this year.She reasoned that there are fears caused by the slowing rate of inflation. Despite this, Brainard still actively advocates the beginning of the Central Bank balance sheet reduction saying that it will happen "in the near future." She said that the strong labor market indicates an acceleration in economic activity and that this chance should not be missed. It is necessary to start a smooth and, most importantly, an expected reduction in the bank balance of $4.5 trillion which was mainly accumulated during the three quantitative easing programs.

The most radical comment came from a well-known opponent of the monetary policy tightening, Fed member, Neel Kashkari. The President of the Federal Reserve Bank of Minneapolis, Kashkari, said yesterday that the slowdown in wage growth rate indicates the absence of "overheating" in the economy. Hence, inflationary pressure is not so strong. That's why there is no reason for raising interest rates. He once again confirmed the thesis that the rate hike is a mistake and can lead to negative consequences. Kashkari is the most consistent opponent of tightening the Fed's monetary policy.

Of course, against this background and because of today's expectations on Federal Reserve head, Janet Yellen's speech to the US Congress, the dollar on Tuesday dropped significantly against the euro and the yen. This is caused by the uncertainty in market regarding what the head of the world's biggest central bank would say.

It can be assumed that if her speech is reasonably optimistic today, then the weakening of the dollar will soon stop and it may even grow against the euro and the yen on the wave of partial closure of long positions in these currencies. Further growth in the dollar may resume only if Friday's inflation data in the States prove to be positive. However, if Yellen expresses even some doubt that interest rates will be raised this year again, then the weakening of the dollar will continue. This will also increase the wave of inflation data that is already high, if she disappoints. Forecast of the day:

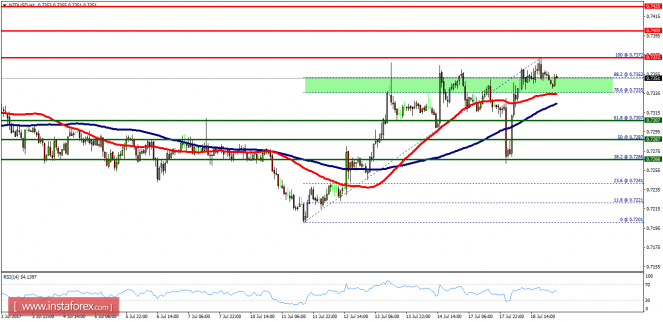

The EUR/USD currency pair is corrected down after reaching a new local maximum, However, it can continue to decline on if the speech to the Congress of the head of the Federal Reserve, Janet Yellen, contains positive sentiment regarding the prospects of the US economy. On this wave, the price decline below the 1.1445 mark may turn lower to the 1.1385 mark and then to 1.1320.

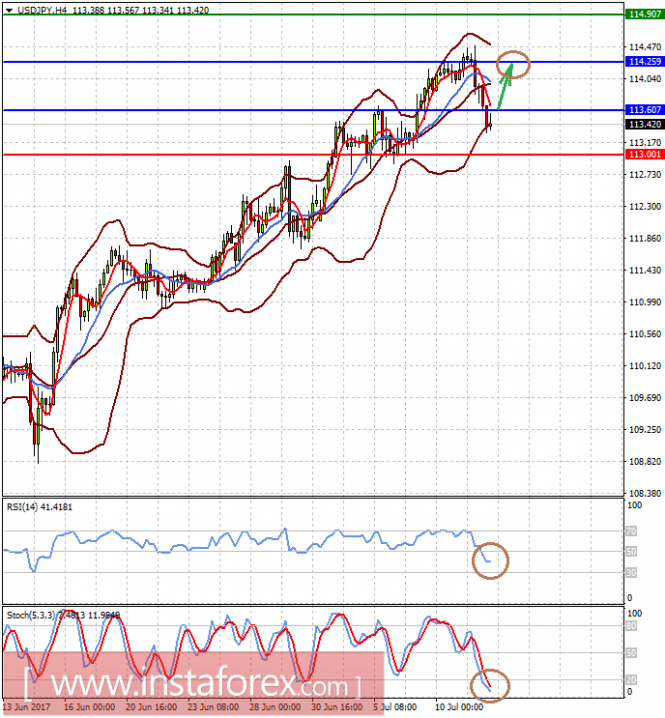

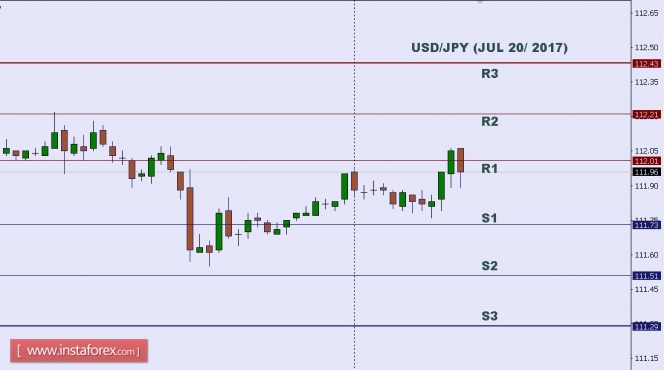

The USD/JPY currency pair fell on the wave of uncertain growth in the Fed's monetary policy report which will be presented today along with Yellen's speech in the Congress. However, the situation may change if the report and the speech are positive. In this case, the price can overcome the 113.60 mark and strive to the 114.25 mark.

Analysis are provided byInstaForex.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks