AUD/JPY reversing nicely below major resistance

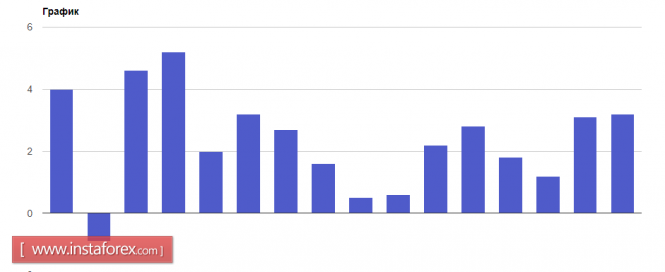

The price has started to form a really nice reversal pattern with bearish divergence being formed. We look to sell below major resistance at 86.67 (Multiple Fibonacci retracements, horizontal overlap resistance, bearish divergence) for a push down to at least 84.69 support (Fibonacci extension, horizontal swing low support).

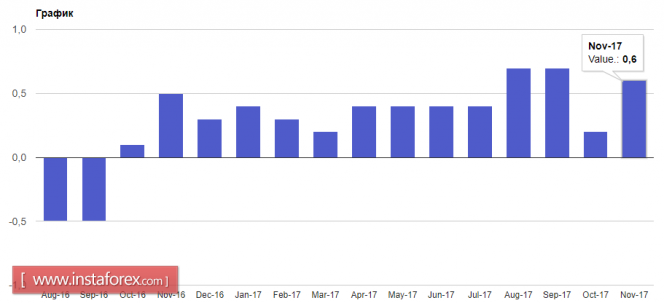

Stochastic (55,3,1) is seeing major resistance below 98% where we expect a corresponding drop from. We're also seeing bearish divergence vs price signaling that a reversal is impending.

Sell below 86.67. Stop loss is at 87.34 Take profit is at 84.69.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis are provided byInstaForex.

3Likes

3Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks