The trading plan for the US session is EUR/USD and GBP/USD

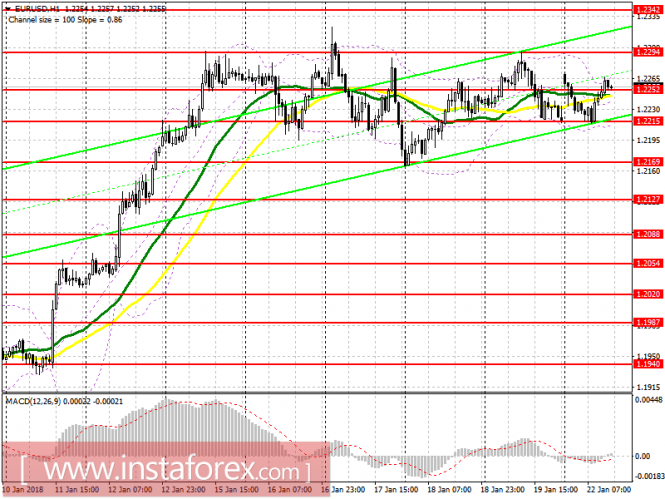

EUR/USD

To open long positions for EURUSD, it is required:

Buyers are trying to get ahold of the level of 1.2252, and while the trade is higher, a chance remains for continued growth of the euro with an update of 1.2294 and the main purpose of a test at 1.2342, where I recommend locking in profits. In the event of a decline below the level of 1.2252 in the afternoon, consider new purchases of the euro after a test at the level of 1.2215, or immediately towards a rebound from 1.2169.

To open short positions for EURUSD, it is required:

A return to the level of 1.2252 would be a good signal to increase short positions on the euro for the purpose of a breakdown and consolidation below the support of 1.2215, which opens a direct road to the area of 1.2169, where I recommend locking in profits. In case the euro further grows, it is possible to look for short positions after the formation of a false breakout at 1.2294 or on a rebound from 1.2342.

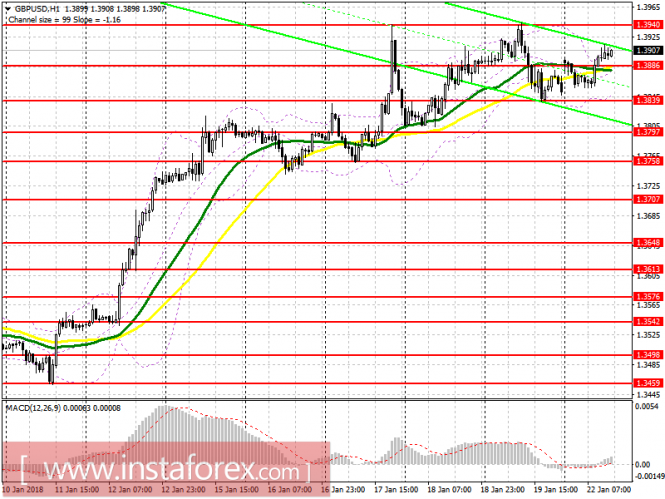

GBP/USD

To open long positions for GBP/USD, it is required: Buyers are trying to work out a scenario in the morning in order to consolidate above 1.3886, and while the trade is at this level, you can count on continuing an upward trend with an exit towards a resistance of 1.3940. The main target remains in the area of 1.4018. In the event of a return below the level of 1.3886, I recommend that you pay attention to long positions on the pound only after a test at 1.3839.

To open short positions for GBP/USD, it is required:

The return at 1.3886 will signal an opening of short positions for the pound, which will lead to the renewal of daily lows in the area of 1.3839 and will likely reach a new support level of 1.3797, where I recommend locking in the profit. In case of continued growth in the pound during the afternoon, short positions can be considered for a rebound from 1.3940.

Indicator description

Moving Average (average sliding) 50 days - yellow

Moving Average (average sliding) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA Bollinger Bands 20

Analysis are provided byInstaForex.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks